Blackberry 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Other

Revenue from the sale of accessories and OEM radios is recognized when title is transferred to the customer

and all significant contractual obligations that affect the customer’s final acceptance have been fulfilled.

Provisions are made at the time of sale for applicable warranties, royalties and estimated product returns.

Revenue for non-recurring engineering contracts is recognized as specific contract milestones are met. The

attainment of milestones approximates actual performance. Revenue from repair and maintenance programs

is recognized when the service is delivered, which is when the title is transferred to the customer and all

significant contractual obligations that affect the customer’s final acceptance have been fulfilled.

Multiple-Element Arrangements

The Company enters into transactions that represent multiple-element arrangements, which may include

any combination of hardware, service and software. These multiple-element arrangements are assessed to

determine whether they can be separated into more than one unit of accounting or element for the purpose

of revenue recognition. When the appropriate criteria for separating revenue into more than one unit of

accounting is met and there is vendor specific objective evidence of fair value for all units of accounting or

elements in an arrangement, the consideration is allocated to the separate units of accounting or elements

based on each unit’s relative fair value. This vendor specific objective evidence of fair value is established

through prices charged for each revenue element when that element is sold separately. The revenue

recognition policies described above are then applied to each unit of accounting.

Allowance for Doubtful Accounts and Bad Debt Expense

The Company is dependent on a number of significant customers and on large complex contracts with

respect to sales of the majority of its products, software and services. The Company expects increasing trade

receivables balances with its large customers to continue as it sells an increasing number of its wireless

handheld and software products and service relay access through network carriers and resellers rather than

directly. The Company evaluates the collectibility of its trade receivables based upon a combination of factors

on a periodic basis.

When the Company becomes aware of a customer’s inability to meet its financial obligations to the Company

(such as in the case of bankruptcy filings or material deterioration in the customer’s financial position and

payment experience), RIM records a specific bad debt provision to reduce the customer’s related trade

receivable to its estimated net realizable value. If circumstances related to specific customers change, the

Company’s estimates of the recoverability of trade receivables could be further adjusted.

Inventory

Raw materials are stated at the lower of cost and replacement cost. Work in process and finished goods

inventories are stated at the lower of cost and net realizable value. Cost includes the cost of materials plus

direct labor applied to the product and the applicable share of manufacturing overhead. Cost is determined on

a first-in-first-out basis.

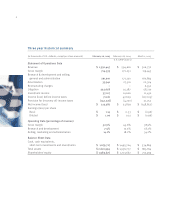

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003