Blackberry 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

The Company’s estimates of costs are based upon historical experience and expectations of future return

rates and unit warranty repair cost. To the extent that the Company experiences increased or decreased

warranty activity, or increased or decreased costs associated with servicing those obligations, revisions

to the estimated warranty liability would be required.

(v) Advertising costs

The Company expenses all advertising costs as incurred. These costs are included in Selling, marketing

and administration.

2. Adoption of Accounting Policies

(a) Stock-based compensation

In December, 2002 the Financial Accounting Standards Board (“FASB”) issued SFAS 148, Accounting for Stock-

Based Compensation. SFAS 148 amends SFAS 123 to provide alternative methods of transition for a voluntary

change to the fair-value based method of accounting for stock-based compensation. There was no effect on

the Company’s results of operations and financial position as a result of SFAS 148, as the Company has not yet

adopted the fair-value based method.

(b) Other-than-temporary impairment of certain investments

The Emerging Issues Task Force released Issue No. 03-01 Other-Than-Temporary Impairment and its

Application to Certain Investments (“EITF 03-01”). EITF 03-01 is applicable to companies with year-ends after

December 15, 2003. In September 2004, the FASB delayed the implementation of EITF 03-01; however the

disclosure requirements remain effective.

(c) Change in capital assets amortization method

During the year, the Company reviewed the estimated useful lives of capital assets used in manufacturing,

and research and development operations and the application of the 20% declining balance amortization

method. As a result of plant capacity and capital asset utilizations currently approaching 100%, versus much

lower levels in prior fiscal years, the Company now believes that the 20% declining balance method will not

produce quarterly and annual amortization expense and resulting residual net book values that are consistent

with the increased current and future capital asset usage. The Company revised its amortization method to

a straight-line method and determined estimated useful lives to be between five and eight years for such

capital assets, on a prospective basis, effective the second quarter of fiscal 2005. The impact of this change

in method of accounting was insignificant for fiscal 2005.

(d) Consolidation of variable interest entities

In December 2003, the FASB amended Interpretation No. 46, Consolidation of Variable Interest Entities

(“FIN 46R”). FIN 46R requires that a variable interest entity (“VIE”) be consolidated by a company

if that company is subject to a majority of the risk of loss from the VIE’s residual returns. The adoption

of FIN 46R had no impact on the Company’s consolidated financial statements.

3. Recently Issued Pronouncements

(a) Equity method of accounting to investments

In June 2004, the Emerging Issues Task Force released Issue No. 02-14 Whether an Investor Should Apply the

Equity Method of Accounting to Investments other than Common Stock (“EITF 02-14”). EITF 02-14 addresses

the situation where an investor does not own an investment in the common stock, but exercises significant

influence over the financial and operating policies of the Company. EITF 02-14 goes on to state that the equity

method of accounting for investments should only be applied when the investor has investments in common

stock, or in-substance common stock and has significant influence over the investee. The Company has

determined that the adoption of EITF 02-14 has no impact on the Company’s consolidated financial statements.

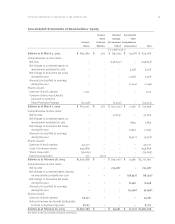

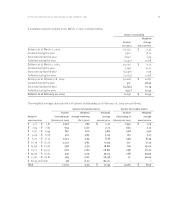

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003