Blackberry 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

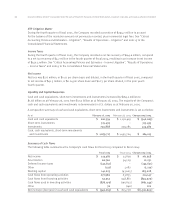

37

Equity Method of Accounting to Investments

In June 2004, the Emerging Issues Task Force released Issue No. 03-01 Whether an Investor Should Apply the

Equity Method of Accounting to Investments other than Common Stock (“EITF 02-14”). EITF 02-14 addresses

the situation where an investor does not own an investment in the common stock, but exercises significant

influence over the financial and operating policies of the Company. EITF 02-14 goes on to state that the equity

method of accounting for investments should only be applied when the investor has investments in common

stock, or in-substance common stock and have significant influence over the Company. The Company has

determined that the adoption of EITF 02-14 has no impact on the Company’s financial statements.

Inventory Costs

In November 2004, the FASB issued SFAS 151 Inventory Costs. SFAS 151 amends Accounting Research Bulletin

(“ARB”) 43 to clarify the accounting treatment of several abnormal inventory type costs. This standard is in

effect for fiscal years beginning after June 15, 2005. The Company does not expect that the adoption of this

standard will have a significant impact on its consolidated financial statements.

Exchanges of Non-Monetary Assets

In December 2004, the FASB issued SFAS 153 Exchanges of Non-Monetary Assets. SFAS 153 amends APB

Opinion 29 to eliminate the exception for non-monetary exchanges of similar productive assets and replaces

it with a general exception for exchanges of non-monetary assets that do not have commercial substance.

This standard is in effect for fiscal years beginning after June 15, 2005. The Company does not expect that

the adoption of this standard will have a significant impact on its consolidated financial statements.

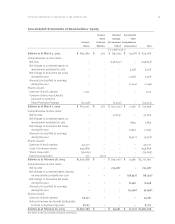

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003