Blackberry 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Credit and Customer Concentration

RIM has historically been dependent on a small but increasing number of significant customers and on large

complex contracts with respect to sales of the majority of its products. The Company expects this trend to

continue as it sells an increasing number of its products and service relay access through network carriers

and resellers rather than directly. The Company is undergoing significant sales growth in North America and

internationally, resulting in the growth in its carrier customer base in terms of numbers, sales and trade

receivables volumes and in some instances new or significantly increased credit limits. The Company, in the

normal course of business, monitors the financial condition of its customers and reviews the credit history

of each new customer. The Company establishes an allowance for doubtful accounts that corresponds to the

specific credit risk of its customers, historical trends and economic circumstances. The Company also places

insurance coverage for a portion of its foreign trade receivables. The allowance as at February 26, 2005 is

$1.7 million (February 28, 2004 – $2.4 million).

While the Company sells to a variety of customers, two customers comprised 23% and 12% of trade

receivables as at February 26, 2005 (February 28, 2004 – two customers comprised 24% and 10%).

Additionally, four customers comprised 14%, 13%, 13% and 10% of the Company’s sales (fiscal 2004 –

two customers comprised 15% and 13%).

The Company is exposed to credit risk on derivative financial instruments arising from the potential for

counterparties to default on their contractual obligations to the Company. The Company minimizes this risk by

limiting counterparties to major financial institutions and by continuously monitoring their creditworthiness.

As at February 26, 2005 the maximum exposure to a single counterparty was 38% of outstanding derivative

instruments (February 28, 2004 – 43%).

The Company is exposed to market and credit risk on its investment portfolio. The Company limits this risk

by investing only in liquid, investment grade securities and by limiting exposure to any one entity or group

of related entities. As at February 26, 2005, no single issuer represented more than 9% of the total cash,

cash equivalents and investments (February 28, 2004 – no single issuer represented more than 4% of the

total cash, cash equivalents and short-term investments).

Impact of Accounting Pronouncements Not Yet Implemented

Stock-Based Compensation

On December 16, 2004, the FASB issued amended SFAS 123 (“SFAS 123R”) Accounting for Share-Based

Payment. SFAS 123(R) requires all companies to use the fair-value based method of accounting for stock-

based compensation, and is in effect for all interim periods ending after June 15, 2005. SFAS 123(R) requires

that all companies adopt either the MPT or MRT approach. Stock compensation expense calculated using

the MPT approach would be recognized on a prospective basis in the financial statements over the requisite

service period, while the MRT method allows a restatement of prior period for amounts previously recorded

as proforma expense. On April 14, 2005, the SEC announced that it would provide for a phased-in

implementation process for SFAS 123(R). The Company will now be required to adopt a fair-value based

method in the first quarter of fiscal 2007.

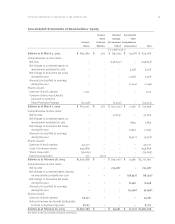

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)