Blackberry 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

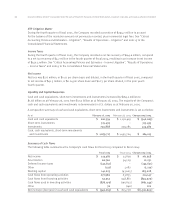

Fiscal 2004 Year

Fourth Third Second First

Quarter Quarter Quarter Quarter

(in thousands, except per share data)

Revenue $ 210,585 $ 153,891 $ 125,679 $ 104,461

Gross margin (3) 103,476 72,398 52,968 42,409

Research and development, Selling, marketing and

administration (3), and Amortization (3) 56,889 49,132 47,388 45,632

Litigation (1) 12,874 9,201 5,653 7,459

Investment income (3,624) (2,264) (2,222) (2,496)

Income (loss) before income taxes 37,337 16,329 2,149 (8,186)

Recovery of income taxes (2) (4,200) – – –

Net income (loss) $ 41,537 $ 16,329 $ 2,149 $ (8,186)

Earnings (loss) per share (4)

Basic $ 0.24 $ 0.10 $ 0.01 $ (0.05)

Diluted $ 0.23 $ 0.10 $ 0.01 $ (0.05)

Research and development $ 17,877 $ 15,673 $ 14,701 $ 14,387

Selling, marketing and administration (3) 32,310 26,233 25,424 24,525

Amortization (3) 6,702 7,226 7,263 6,720

$56,889 $ 49,132 $ 47,388 $ 45,632

Notes:

(1) See “Results of Operations – Litigation” and note 15 to the Consolidated Financial Statements.

(2)See “Results of Operations – Income Taxes” and note 9 to the Consolidated Financial Statements.

(3)During the third quarter of fiscal 2004, the Company reclassified costs associated with its BlackBerry network operations

center and its technical and service support operations center to Cost of sales. Such costs were previously included in Selling,

marketing and administration expense. In addition, amortization expense related to manufacturing operations and BlackBerry

network operations has been reclassified to Cost of sales. Such amortization was previously included in Amortization expense.

All comparative amounts were reclassified to conform to this new presentation. There were no adjustments to previously

reported net income (loss) as a result of any of these reclassifications.

(4)See “Stock Split” and note 11 (a) to the Consolidated Financial Statements.

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003