Blackberry 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

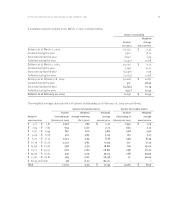

Available-for-sale investments are carried at fair value and comprise the following:

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

As at February 26, 2005

Government sponsored enterprise notes $377,492 $ 82 $ (6,198) $ 371,376

Asset-backed securities 227,255 39 (2,444) 224,850

Commercial paper and corporate bonds 352,173 813 (4,637) 348,349

Auction-rate securities 124,788 – – 124,788

$1,081,708 $ 934 $ (13,279) $1,069,363

Classified as Short-Term $314,931 $ 912 $ (348) $ 315,495

Classified as Long-Term 766,777 22 (12,931) 753,868

Total $1,081,708 $ 934 $ (13,279) $1,069,363

As at February 28, 2004

Government sponsored enterprise notes $ 80,086 $ 300 $ – $ 80,386

Asset-backed securities 90,043 1,350 (16) 91,377

Corporate bonds and notes 163,144 4,397 (19) 167,522

$333,273 $ 6,047 $ (35) $ 339,285

Classified as Short-Term $ – $ – $ – $ –

Classified as Long-Term 333,273 6,047 (35) 339,285

Total $ 333,273 $ 6,047 $ (35) $ 339,285

Realized gains and losses on available-for-sale securities comprise the following:

February 26, 2005 February 28, 2004 March 1, 2003

Realized gains $– $16 $ 10

Realized losses –(22) (1)

$– $(6) $ 9

Fair value and unrealized losses position for available-for-sale securities as at February 26, 2005.

Less than 12 months 12 months or more Total

Unrealized Unrealized Unrealized

Fair Value losses Fair Value losses Fair Value losses

Government sponsored

enterprise notes $– $– $351,685 $ 6,198 $ 351,685 $ 6,198

Asset-backed securities – – 215,683 2,444 215,683 2,444

Commercial paper and

corporate bonds 56,267 155 237,989 4,482 294,256 4,637

$56,267 $ 155 $ 805,357 $ 13,124 $ 861,624 $ 13,279

Unrealized losses for government sponsored enterprise notes, asset-backed securities and commercial

paper and corporate bonds were caused by increases in interest rates. The Company does not believe that

it is probable that it will be unable to collect all amounts due according to the contractual terms of the

investments. The Company has the ability and intent to hold these investments, until there is a recovery

of fair value, which may be at maturity. As a result, the Company does not consider these investments

to be other-than-temporarily impaired as at February 26, 2005.

Investments carry weighted average yields of 3.1% as at February 26, 2005 (February 28, 2004 – 3.1%).

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003