Blackberry 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

(b) Stock-based compensation

On December 16, 2004, the FASB issued amended SFAS 123 (“SFAS 123(R)”) Accounting for Share-Based

Payment. SFAS 123(R) requires all companies to use the fair-value based method of accounting for

stock-based compensation, and is in effect for all interim periods beginning after June 15, 2005. SFAS 123(R)

requires that all companies adopt either the modified prospective transition (“MPT”) or modified retrospective

transition (“MRT”) method. Stock compensation expense calculated using the MPT approach would be

recognized on a prospective basis in the financial statements over the requisite service period, while the

MRT method allows a restatement of prior periods for amounts previously recorded as proforma expense.

On April 14, 2005, the U.S. Securities and Exchange Commission announced that it would provide for a

phased-in implementation process for SFAS 123(R). The Company will now be required to adopt a fair-value

based method in the first quarter of fiscal 2007.

(c) Inventory costs

In November 2004, the FASB issued SFAS 151 Inventory Costs. SFAS 151 amends Accounting Research Bulletin

(“ARB”) 43 to clarify the accounting treatment of several abnormal inventory type costs. This standard is in

effect for fiscal years beginning after June 15, 2005. The Company does not expect that the adoption of this

standard will have a significant impact on its consolidated financial statements.

(d) Exchanges of non-monetary assets

In December 2004, the FASB issued SFAS 153 Exchanges of Non-Monetary Assets. SFAS 153 amends APB

Opinion 29 to eliminate the exception for non-monetary exchanges of similar productive assets and replaces

it with a general exception for exchanges of non-monetary assets that do not have commercial substance. This

standard is in effect for exchanges occurring in fiscal years beginning after June 15, 2005. The Company does not

expect that the adoption of this standard will have a significant impact on its consolidated financial statements.

4. Cash and Cash Equivalents and Investments

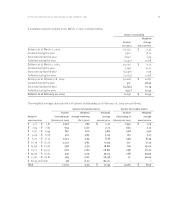

(a) Cash and cash equivalents are recorded at fair value and comprise the following:

February 26, 2005 February 28, 2004

Balances with banks $26,005 $2,644

Money market investment funds –9,657

Certificates of deposit 10,012 255,199

Repurchase agreements 907 110,622

Commercial paper and corporate notes 573,430 778,297

$610,354 $1,156,419

Cash and cash equivalents carry weighted average yields of 2.5% as at February 26, 2005

(February 28, 2004 – 1.0%).

(b) Investments consist of money-market and other debt securities and are classified as

available-for-sale investments.

As at February 26, 2005, the contractual maturities of debt securities were as follows (at carrying value):

Years to Maturity

Less than One to Five to Over Ten No Single

One Year Five Years Ten Years Years Maturity Date Total

Available-for-sale $56,267 $ 675,902 $ – $ 112,344 $ 224,850 $ 1,069,363

Securities with no single maturity date reflect asset-backed securities.

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)