Blackberry 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

As at February 26, 2005, the Company has a $70 million Letter of Credit Facility (the “Facility”) with a Canadian

financial institution and has utilized $48 million of the Facility in order to secure the Company’s liability and

funding obligation in the NTP matter, as described in note 15. During the third quarter of fiscal 2004 and

pending the completion of the appeals process, the Company, with the approval of the Court, posted a Standby

Letter of Credit (“LC”) in the amount of $48 million so as to guarantee the monetary damages of the Court’s

Final Order. The LC amount of $48 million excludes the fiscal 2004 and 2005 quarterly deposit obligations

funded into the escrow bank account, which are shown as Restricted cash on the Company’s consolidated

balance sheets.

The Company has utilized an additional $5.1 million of the Facility to secure other operating and financing

requirements. $16.9 million of the Facility was unused as at February 26, 2005. The Company has pledged

specific investments as security for this Facility.

The Company has additional credit facilities in the amount of $16.3 million to support and secure other

operating and financing requirements; as at February 26, 2005, $14.7 million of these facilities was unused.

A general security agreement, a general assignment of book debts and cash has been provided as collateral

for these facilities.

11. Capital Stock

(a) Share capital

The Company is authorized to issue an unlimited number of non-voting, redeemable, retractable Class A

common shares, an unlimited number of voting common shares and an unlimited number of non-voting,

cumulative, redeemable, retractable preferred shares. There are no Class A common shares or preferred

shares outstanding.

The Company declared an effective two for one stock split in the form of a one for one stock dividend payable

on June 4, 2004 for all shareholders of record as at close of business on May 27, 2004. All common share,

earnings per share and stock option data for the current, year to date and prior comparative periods have

been adjusted to reflect this stock dividend. In addition, the effect of this stock dividend doubled the number

of stock options outstanding and reduced the exercise prices of these stock options by half of the original

exercise price.

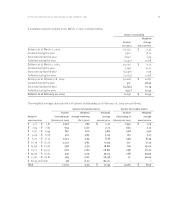

The following details the changes in issued and outstanding common shares and common share purchase

warrants for the three years ended February 26, 2005:

Number Outstanding (000’s)

Common share

Common purchase

shares warrants

Balance as at March 2, 2002 157,582 150

Exercise of options 640 –

Common shares repurchased pursuant to Common Share

Purchase Program (3,878) –

Balance as at March 1, 2003 154,344 150

Exercise of options 6,258 –

Exercise of warrants 78 (150)

Common shares issued pursuant to public share offering 24,150 –

Balance as at February 28, 2004 184,830 –

Exercise of options 4,655 –

Balance as at February 26, 2005 189,485 –

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003