Blackberry 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

As a result of the NTP resolution during the fourth quarter of fiscal 2005 as described in note 15, the Company

has now recognized a deferred tax benefit of $1,083 related to a fiscal 2003 acquisition. This amount resulted

in a reduction of Goodwill.

During fiscal 2004, the purchase price related to one of the fiscal 2003 acquisitions was revised, resulting in

a reduction to goodwill of $478 and a return of consideration.

During fiscal 2003 the Company completed four acquisitions. Effective June 2002, the Company purchased

the assets of a company whose proprietary software code provides capabilities to facilitate foreign language

input and display on handheld products. Effective July 2002, the Company acquired 100% of the common

shares of a company that will offer a secure solution for viewing email attachments with BlackBerry Wireless

Handhelds. Effective August 2002, the Company acquired 100% of the common shares of a company that has

software products which enable wireless access to major email systems including corporate, proprietary and

POP3/IMAP4 using a handheld device. In addition, effective September 2002, the Company also acquired

100% of the common shares of a small company with expertise and technology related to wireless networks.

The results of the acquirees’ operations have been included in the consolidated financial statements

commencing from each respective closing date to February 26, 2005.

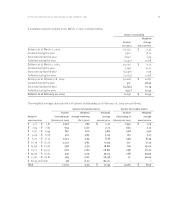

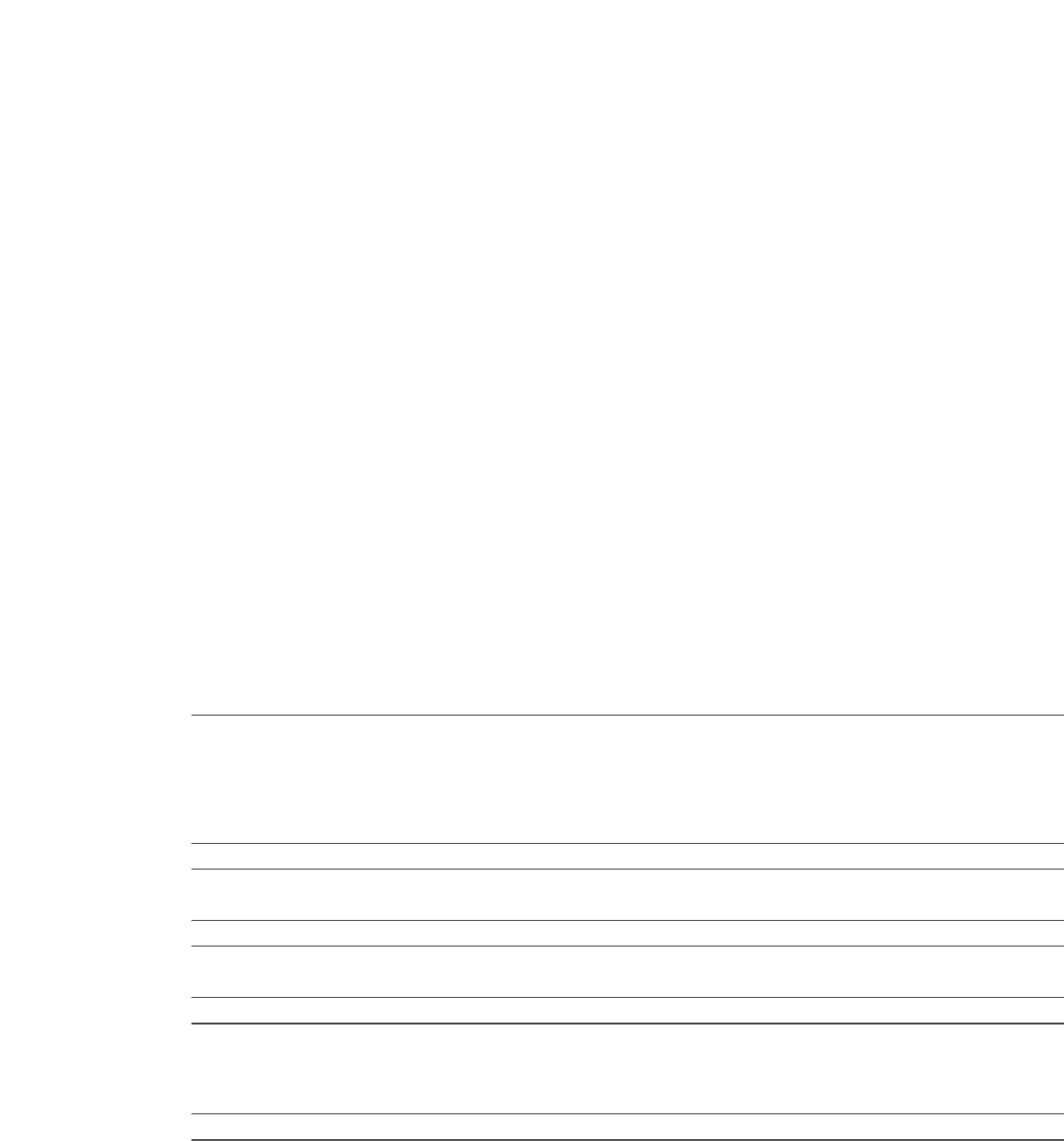

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the

date of acquisition:

For the year ended February 26, 2005 February 28, 2004 March 1, 2003

Assets purchased

Capital assets $–$– $317

Deferred tax asset 2,889 – –

Acquired technology 2,140 – 7,326

Goodwill (1,083) (478) 16,193

3,946 (478) 23,836

Liabilities assumed 58 – 1,275

Deferred income tax liability – – 357

58 – 1,632

Net non-cash assets acquired 3,888 (478) 22,204

Cash acquired 23 – 117

Net assets acquired $ 3,911 $(478) $ 22,321

Consideration

Cash $3,911 $(478) $ 22,107

Assumption of acquiree long-term debt –– 214

$3,911 $(478) $ 22,321

The acquisitions were accounted for using the purchase method whereby assets acquired and liabilities

assumed were recorded at their fair value as of the date of acquisition. The excess of the purchase price

over such fair value was recorded as goodwill. Acquired technology includes current and core technology.

The Company’s purchase price allocations with respect to the fiscal 2003 acquisitions resulted in goodwill

of $16,193 of which $13,316 is expected to be deductible for tax purposes.

Research In Motion Limited •Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)