Blackberry 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company expects this net migration to continue in fiscal 2006 as data-only BlackBerry subscribers

upgrade to voice-enabled handhelds. Consequently, the average monthly revenue per subscriber is expected

to continue to decline in fiscal 2006 as a result of: i) the aforementioned net migration; and (ii) the continuing

net increase in the BlackBerry subscriber base attributable to relay access subscribers for which RIM receives

a lower monthly service fee from its carrier customers.

Software revenues include fees from licensed BES software, CALs, technical support, maintenance and

upgrades. Software revenues increased $84.4 million to $131.8 million in fiscal 2005 from $47.4 million

in fiscal 2004, as a result of increased sales of BES software, particularly with the introduction of the new

BES 4.0 during the fourth quarter of fiscal 2005, and increased sales of CALs consistent with the growth

in BlackBerry subscribers.

Other revenue, which includes accessories, non-warranty repairs, NRE, technical support, OEM radios, and

other, increased by $16.8 million to $49.6 million in fiscal 2005, compared to $32.8 million in fiscal 2004.

Growth in revenue streams such as accessories, NRE and non-warranty repair was partially offset by a

reduction in OEM radio revenue in fiscal 2005.

Gross Margin

Gross margin increased by $443.3 million, or 163.4 %, to $714.5 million, or 52.9% of revenue, in fiscal 2005,

compared to $271.3 million, or 45.6% of revenue, in the previous fiscal year. The net improvement of 7.3%

in consolidated gross margin percentage was primarily due to the following factors:

•Software revenues at $131.8 million comprised 9.8% of the total revenue mix in fiscal 2005, compared to

$47.4 million and 8.0% respectively in fiscal 2004;

•An increase in NRE revenue in the current year;

•Improved service margins resulting from cost efficiencies in RIM’s network operations infrastructure as a

result of the increase in BlackBerry subscribers;

•Reductions in handheld unit warranty rates and net warranty expense (see “Critical Accounting Policies and

Estimates – Warranty” and note 13 to the Consolidated Financial Statements); and

•A decline in amortization expense as a percentage of consolidated revenue, as the Company continues to

realize economies of scale in its manufacturing operations.

23

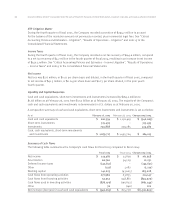

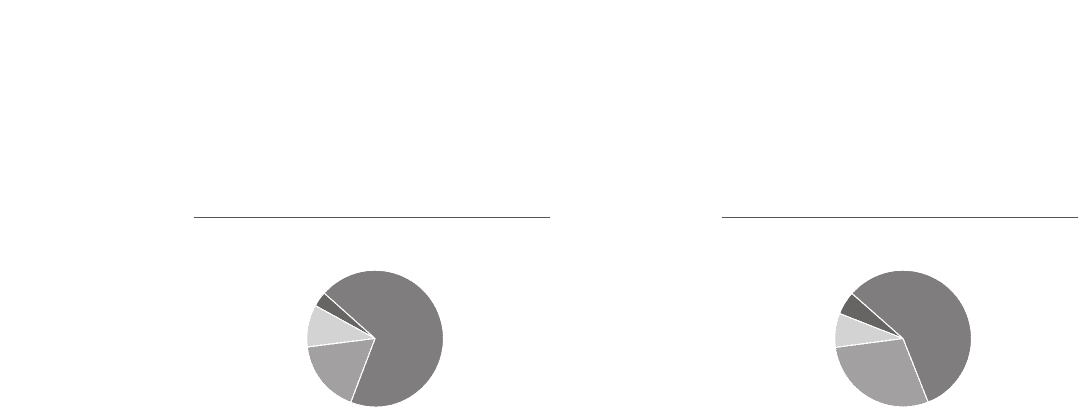

For the years ended February 26, 2005, February 28, 2004 and March 1, 2003

17.4%

Service

69.2%

Handhelds

9.8%

Software

28.8%

Service

57.7%

Handhelds

Revenue Mix Fiscal 2004Revenue Mix Fiscal 2005

3.6%

Other

8.0%

Software

5.5%

Other