Bed, Bath and Beyond 2013 Annual Report Download - page 75

Download and view the complete annual report

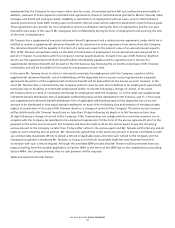

Please find page 75 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(4) Information regarding Brown Brothers Harriman & Co. was obtained from a Schedule 13G filed with the SEC on May 13, 2014 by

Brown Brothers Harriman & Co. The Schedule 13G states that Brown Brothers Harriman & Co. is deemed to have beneficial

ownership of 10,272,619 shares of common stock, acquired in the ordinary course of business. The Schedule 13G also states that

Brown Brothers Harriman & Co. has the sole power to dispose or to direct the disposition of 3,060,708 shares of common stock. The

address of Brown Brothers Harriman & Co. is 140 Broadway, New York, NY 10005.

(5) The shares shown as being owned by Mr. Eisenberg include: (a) 1,263,430 shares owned by Mr. Eisenberg individually;

(b) 342,672 shares issuable pursuant to stock options granted to Mr. Eisenberg that are or become exercisable within 60 days;

(c) 500,000 shares owned by a foundation of which Mr. Eisenberg and his family members are trustees and officers;

(d) 532,671 shares owned by trusts for the benefit of Mr. Eisenberg and his family members; (e) 669,068 shares owned by his

spouse; and (f) 82,327 shares of restricted stock. Mr. Eisenberg has sole voting power with respect to the shares held by him

individually and in trust for his benefit but disclaims beneficial ownership of any of the shares not owned by him individually and

in trust for the benefit of his family members.

(6) The shares shown as being owned by Mr. Feinstein include: (a) 1,187,963 shares owned by Mr. Feinstein individually;

(b) 342,672 shares issuable pursuant to stock options granted to Mr. Feinstein that are or become exercisable within 60 days;

(c) 350,000 shares owned by a foundation of which Mr. Feinstein and his family members are trustees and officers;

(d) 341,240 shares owned by his spouse; and (e) 82,327 shares of restricted stock. Mr. Feinstein has sole voting power with respect

to the shares held by him individually and in trust for his benefit but disclaims beneficial ownership of any of the shares not owned

by him individually and in trust for the benefit of his family members.

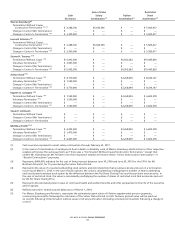

(7) The shares shown as being owned by Mr. Temares include: (a) 307,948 shares owned by Mr. Temares individually;

(b) 1,207,366 shares issuable pursuant to stock options granted to Mr. Temares that are or become exercisable within 60 days;

(c) 187,144 shares issuable pursuant to stock options that are exercisable held by a family limited partnership, of which Mr. Temares

and his spouse are the sole general partners, and of which Mr. Temares and his spouse serve as limited partners together with trusts

for the benefit of Mr. Temares, his spouse and his children; (d) 14,286 shares owned by the above described family limited

partnership; (e) 5,000 shares owned by a family limited partnership established by Mr. Temares’ mother; and (f) 286,728 shares of

restricted stock. Mr. Temares has sole voting power with respect to the shares held by him individually and the above described

family limited partnership but disclaims beneficial ownership of the shares owned by the family limited partnership established by

Mr. Temares’ mother, except to the extent of his pecuniary interest therein.

(8) The shares shown as being owned by Mr. Stark include: (a) 47,693 shares owned by Mr. Stark individually; (b) 126,205 shares

issuable pursuant to stock options that are or become exercisable within 60 days; and (c) 122,960 shares of restricted stock.

(9) The shares shown as being owned by Mr. Castagna include: (a) 44,293 shares owned by Mr. Castagna individually; (b) 144,410 shares

issuable pursuant to stock options that are or become exercisable within 60 days; and (c) 101,005 shares of restricted stock.

(10) The shares shown as being owned by Ms. Lattmann include: (a) 6,671 shares owned by Ms. Lattmann individually; and

(b) 21,986 shares of restricted stock.

(11) The shares shown as being owned by Mr. Fiorilli include: (a) 39,725 shares owned by Mr. Fiorilli individually; (b) 144,410 shares

issuable pursuant to stock options that are or become exercisable within 60 days; (c) 1,600 shares owned by an immediate family

member; and (d) 97,322 shares of restricted stock. Mr. Fiorilli has sole voting power with respect to the shares held by him

individually but disclaims beneficial ownership of the shares owned by an immediate family member.

(12) Ms. Elliott was elected to the Board of Directors effective February 20, 2014.

Certain Relationships and Related Transactions

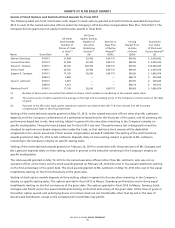

The Company’s Audit Committee reviews and, if appropriate, approves transactions brought to the Committee’s attention in

which the Company is a participant and the amount involved exceeds $120,000, and in which, in general, beneficial owners of

more than 5% of the Company’s common stock, the Company’s directors, nominees for director, executive officers, and

members of their immediate families, have a direct or indirect material interest. The Committee’s responsibility with respect to

the review and approval of these transactions is set forth in the Audit Committee’s charter.

A brother-in-law of Arthur Stark, the Company’s President, earned in his capacity as a sales representative employed by Blue

Ridge Home Fashions commissions (aggregating approximately $290,000) on sales of merchandise in fiscal 2013 by Blue Ridge

Home Fashions to the Company in the amount of approximately $28.9 million, and a son-in-law of Mr. Stark is a managing

member and has a minority equity interest in Colordrift LLC which had aggregate sales of merchandise to the Company of

approximately $1.2 million in fiscal 2013. Colordrift LLC had a pre-existing sales relationship with the Company at the time

such managing member became Mr. Stark’s son-in-law, which was during the Company’s fiscal 2012 year.

BED BATH & BEYOND PROXY STATEMENT

73