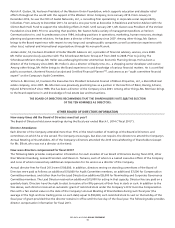

Bed, Bath and Beyond 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

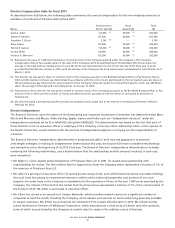

• Equity Incentives — The Company significantly redesigned its equity incentive program for the named executive officers

with respect to fiscal 2014 compensation, with a view towards creating a more direct link between pay and performance

and providing performance metrics fundamental to the business and directed toward shareholder value creation, and that

apply during a one-year period and a three-year period. In connection with the redesign of the equity incentive program,

the Company eliminated the prior one-year performance test and made the following changes.

• Performance during the one-year period will be based on Earnings Before Income Tax (EBIT) margin relative to a peer

group of the Company comprising 50 companies selected within the first 90 days of the performance period.

• Performance during the three-year period will be based on Return on Invested Capital (ROIC) relative to such peer group.

• Awards based on EBIT margin and ROIC are capped at 150% of target achievement, with a floor of zero, and generally

vest over a four-year period.

• As payouts under these awards are contingent upon achievement of various levels of EBIT margin and ROIC relative to

such peer group and the continued performance of services by the executives, the awards will be made in the form of

‘‘performance share units’’ (‘‘PSUs’’), rather than in the form of performance-based restricted stock.

• The equity incentive of all executive officers is weighted so that at least two-thirds of its value is in PSUs and no more

than one-third in stock options.

• The base salary of the Company’s Chief Executive Officer for fiscal 2014 has not been increased from 2013, with such

executive receiving an increase in 2014 equity compensation in line with the increase in total compensation for other

members of senior management if performance targets are met.

• The Compensation Committee believes this redesign is a positive change and it intends to continue to evaluate the

appropriate design of the equity incentive awards, together with all aspects of compensation, from time to time as may be

appropriate.

Equity incentive awards continue to constitute the largest portion of the compensation of our named executive officers.

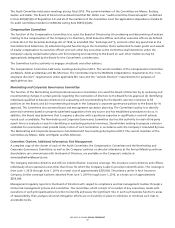

• No Hedge/No Pledge Policy — On the recommendation of the Nominating and Corporate Governance Committee, the

Board of Directors adopted restrictions on engaging in hedging transactions involving the Company’s common stock and on

pledging such common stock, in each case, by the Company’s directors and executive officers.

• Stock Ownership Guidelines — On the recommendation of the Nominating and Corporate Governance Committee, the

Board of Directors adopted stock ownership guidelines that require the Company’s Chief Executive Officer and each outside

director to hold the Company’s common stock with a value of at least $6,000,000 and $300,000, respectively.

• Annual Board and Committee Self-Assessments — On the recommendation of the Nominating and Corporate Governance

Committee, the Board of Directors adopted a policy under which the Company’s Board of Directors and its committees will

conduct a formal self-assessment at least annually.

• Limits on Other Board Service — On the recommendation of the Nominating and Corporate Governance Committee, the

Board of Directors adopted a policy limiting service by the Company’s directors on other public company boards of directors

to no more than two other directorships (in the case of the Company’s Co-Chairmen and Chief Executive Officer) and four

other directorships (in the case of non-executive directors).

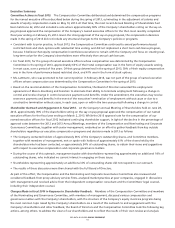

The balance of this Compensation Discussion and Analysis relates to the compensation decisions made in the spring

of 2013. As noted above, at the time these decisions were made, the most recent say-on-pay vote at the Company’s Annual

Shareholder Meeting in 2012 had resulted in approximately 94% shareholder support. These decisions also took into account,

among other things, the following:

• Net sales increased from $9.500 billion in fiscal 2011 to $10.915 billion in fiscal 2012, and net earnings per diluted share

increased from $4.06 to $4.56.

• Acquisitions consummated in June 2012 added to the scope of the Company’s operations and required substantial

integration efforts.

• From fiscal 2009 through fiscal 2012, the Company had returned approximately 70%, or approximately $3.0 billion, of its

cash flow from operations to its shareholders through the Company’s share repurchase programs.

BED BATH & BEYOND PROXY STATEMENT

52