Bed, Bath and Beyond 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Status Period, or, if during the Senior Status Period, one half of Senior Status Salary for the number of years (including

fractions), if any, remaining in the Senior Status Period, payable over such applicable period in accordance with normal payroll

practices. The agreements provide that in the event any amounts paid or provided to the executive in connection with a

change in control are determined to constitute ‘‘excess parachute payments’’ under Section 280G of the Code which would be

subject to the excise tax imposed by Section 4999 of the Code, the payments and benefits due to the executive will be reduced

if the reduction would result in a greater amount payable to the executive after taking into account the excise tax imposed by

Section 4999 of the Code. The agreements also provide that upon a change in control of the Company, the Company will fund

a ‘‘rabbi trust’’ for each of the executives to hold an amount equal to the value of the payments and certain benefits payable

to each of the executives upon his termination of employment with the Company. In the event of termination of employment,

the executives are under no obligation to seek other employment and there is no reduction in the amount payable to the

executive on account of any compensation earned from any subsequent employment. In the event of termination due to

death of either of the executives, the executive’s estate or beneficiary shall be entitled to his salary for a period of one year

following his death and payment of expenses incurred by executive and not yet reimbursed at the time of death. In the event

of termination due to the inability to substantially perform his duties and responsibilities for a period of 180 consecutive days,

the executive shall be entitled to his salary for a period of one year following the date of termination (less any amounts

received under the Company’s benefit plans as a result of such disability). To the extent that any payments under the

employment agreements due following the termination of Messrs. Eisenberg and Feinstein are considered to be deferred

compensation under Section 409A, such amounts will commence to be paid on the earlier of the six-month anniversary of

termination of employment or the executive’s death.

Either of the executives may be terminated for cause upon written notice of the Company’s intention to terminate his

employment for cause, such notice to state in detail the particular act or acts or failure or failures to act that constitute the

grounds on which the proposed termination for cause is based. The executives shall have ten days after such notice is given to

cure such conduct, to the extent a cure is possible. ‘‘Cause’’ generally means (i) the executive is convicted of a felony involving

moral turpitude or (ii) the executive is guilty of willful gross neglect or willful gross misconduct in carrying out his duties under

the agreement, resulting, in either case, in material economic harm to the Company, unless the executive believed in good

faith that such act or non-act was in the best interests of the Company. ‘‘Constructive termination’’ generally means the

executive’s election to terminate employment due to (i) a reduction in the executive’s salary or a material reduction in the

executive’s benefits or perquisites (other than as part of any across-the-board action applicable to all executive officers of the

Company), (ii) removal from, or failure to reelect the executive to, the position of co-chairman or chairman or as a director,

(iii) a material diminution in the executive’s duties, the assignment of duties materially inconsistent with the executive’s duties

or that materially impairs the executive’s ability to function as the co-chairman or chairman or (iv) the Company’s principal

office or the executive’s own office location provided by the Company is relocated and, in any case, not timely cured by the

Company. In addition, pursuant to their respective restricted stock agreements, shares of restricted stock granted to Messrs.

Eisenberg and Feinstein will vest upon death, disability, termination of employment without cause or constructive termination,

and for restricted stock awards granted since fiscal 2009, vesting upon termination without cause or constructive termination

will be subject to attainment of performance goals.

In substitution for a split dollar insurance benefit previously provided to such executives, in fiscal 2003, the Company entered

into deferred compensation agreements with Messrs. Eisenberg and Feinstein under which the Company is obligated to pay

Messrs. Eisenberg and Feinstein $2,125,000 and $2,080,000, respectively, in each case payable only on the last day of the first

full fiscal year of the Company in which the total compensation of Mr. Eisenberg or Feinstein, as applicable, will not result in

the loss of a deduction for such payment pursuant to applicable federal income tax law.

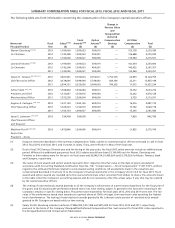

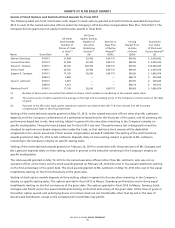

Messrs. Temares, Stark, Castagna and Fiorilli

The agreements with Messrs. Temares, Stark and Fiorilli provide for severance pay equal to three years’ salary, and the

agreement with Mr. Castagna provides for severance pay equal to one year’s salary, if the Company terminates their

employment other than for ‘‘cause’’ (including by reason of death or disability) and one year’s severance pay if the executive

voluntarily leaves the employ of the Company. Severance pay will be paid in accordance with normal payroll, however any

amount due prior to the six months after termination of employment will be paid in a lump sum on the date following the six

month anniversary of termination of employment. Any severance payable to these executives will be reduced by any monetary

compensation earned by them as a result of their employment by another employer or otherwise. ‘‘Cause’’ is defined in the

agreements as when the executive has: (i) acted in bad faith or with dishonesty; (ii) willfully failed to follow reasonable and

lawful directions of the Company’s Chief Executive Officer or the Board of Directors, as applicable, commensurate with his

titles and duties; (iii) performed his duties with gross negligence; or (iv) been convicted of a felony. Upon a termination of

BED BATH & BEYOND PROXY STATEMENT

62