Bed, Bath and Beyond 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Defined Benefit Plan

The Company has a non-contributory defined benefit pension plan for the CTS employees, hired on or before July 31, 2003,

who meet specified age and length-of-service requirements. The benefits are based on years of service and the employee’s

compensation up until retirement. The Company recognizes the overfunded or underfunded status of the pension plan as an

asset or liability in its statement of financial position and recognizes changes in the funded status in the year in which the

changes occur. For the years ended March 1, 2014, March 2, 2013 and February 25, 2012, the net periodic pension cost was not

material to the Company’s results of operations. The Company has a $9.2 million and $14.4 million liability, which is included in

deferred rent and other liabilities as of March 1, 2014 and March 2, 2013, respectively. In addition, as of March 1, 2014 and

March 2, 2013, the Company recognized a loss of $0.5 million, net of taxes of $0.4 million, and a loss of $3.8 million, net of

taxes of $2.5 million, respectively, within accumulated other comprehensive loss.

11. COMMITMENTS AND CONTINGENCIES

The Company maintains employment agreements with its Co-Chairmen, which extend through February 25, 2017. The

agreements provide for a base salary (which may be increased by the Board of Directors), termination payments,

postretirement benefits and other terms and conditions of employment. In addition, the Company maintains employment

agreements with other executives which provide for severance pay and, in some instances, certain other supplemental

retirement benefits.

The Company records an estimated liability related to its various claims and legal actions arising in the ordinary course of

business when and to the extent that it concludes a liability is probable and the amount of the loss can be reasonably

estimated. Such estimated loss is based on available information and advice from outside counsel, where appropriate. As

additional information becomes available, the Company reassesses the potential liability related to claims and legal actions

and revises its estimated liabilities, as appropriate. The Company expects the ultimate disposition of these matters will not

have a material adverse effect on the Company’s consolidated financial position, results of operations or liquidity. The

Company also cannot predict the nature and validity of claims which could be asserted in the future, and future claims could

have a material impact on its earnings.

12. SUPPLEMENTAL CASH FLOW INFORMATION

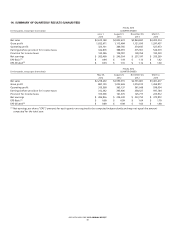

The Company paid income taxes of $562.4 million, $550.6 million and $568.6 million in fiscal 2013, 2012 and 2011, respectively.

In addition, the Company had interest payments of approximately $9.2 million and $6.0 million in fiscal 2013 and 2012,

respectively. The amount of interest paid by the Company in fiscal 2011 was not material.

The Company recorded an accrual for capital expenditures of $50.2 million, $37.0 million and $28.8 million as of March 1,

2014, March 2, 2013 and February 25, 2012, respectively.

13. STOCK-BASED COMPENSATION

The Company measures all employee stock-based compensation awards using a fair value method and records such expense, net

of estimated forfeitures, in its consolidated financial statements. Currently, the Company’s stock-based compensation relates to

restricted stock awards and stock options. The Company’s restricted stock awards are considered nonvested share awards.

Stock-based compensation expense for the fiscal year ended March 1, 2014, March 2, 2013 and February 25, 2012 was

approximately $56.2 million ($35.6 million after tax or $0.17 per diluted share), $47.2 million ($30.0 million after tax or $0.13

per diluted share) and approximately $45.2 million ($28.5 million after tax or $0.12 per diluted share), respectively. In addition,

the amount of stock-based compensation cost capitalized for the years ended March 1, 2014 and March 2, 2013 was

approximately $1.6 million and $1.3 million, respectively.

Incentive Compensation Plans

The Company currently grants awards under the Bed Bath & Beyond 2012 Incentive Compensation Plan (the ‘‘2012 Plan’’),

which amended and restated the Bed Bath & Beyond 2004 Incentive Compensation Plan (the ‘‘2004 Plan’’). The 2012 Plan

includes an aggregate of 43.2 million common shares authorized for issuance and the ability to grant incentive stock options.

Outstanding awards that were covered by the 2004 Plan continue to be in effect under the 2012 Plan.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

BED BATH & BEYOND 2013 ANNUAL REPORT

32