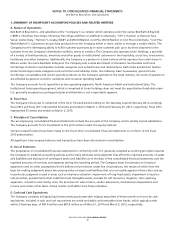

Bed, Bath and Beyond 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On June 29, 2012, the Company acquired Cost Plus, Inc. (‘‘Cost Plus World Market’’), a retailer selling a wide range of home

decorating items, furniture, gifts, holiday and other seasonal items, and specialty food and beverages, for an aggregate

purchase price of approximately $560.5 million, including the payment of assumed borrowings of $25.5 million under a credit

facility. The acquisition was consummated by a wholly owned subsidiary of the Company through a tender offer and merger,

pursuant to which the Company acquired all of the outstanding shares of common stock of Cost Plus World Market. Cost Plus

World Market is included within the North American Retail operating segment. In the first quarter of fiscal 2013, the Company

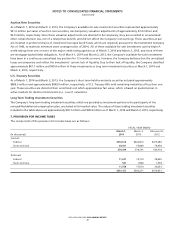

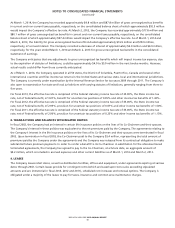

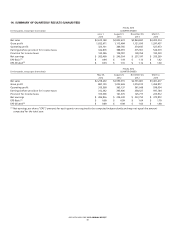

finalized the valuation of assets acquired and liabilities assumed. The following table summarizes the estimated fair value of

the assets acquired and liabilities assumed at the date of acquisition.

(in millions)

As of

June 29, 2012

Current assets $ 222.0

Property and equipment and other non-current assets 132.4

Intangible assets 211.6

Goodwill 247.4

Total assets acquired 813.4

Accounts payable and other liabilities (252.9)

Borrowings under credit facility (25.5)

Total liabilities acquired (278.4)

Total net assets acquired $ 535.0

Included within intangible assets above is approximately $196.5 million for tradenames, which is not subject to amortization.

The tradenames and goodwill are not expected to be deductible for tax purposes.

Since the date of acquisition, the results of Cost Plus World Market’s operations, which are not material, have been included in

the Company’s results of operations and no proforma disclosure of financial information has been presented.

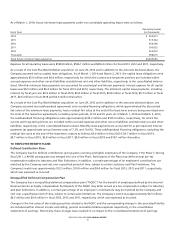

3. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

(in thousands)

March 1,

2014

March 2,

2013

Land and buildings $ 538,422 $ 488,602

Furniture, fixtures and equipment 1,120,330 1,068,786

Leasehold improvements 1,187,793 1,099,991

Computer equipment and software 755,867 613,087

3,602,412 3,270,466

Less: Accumulated depreciation (2,022,608) (1,803,799)

Property and equipment, net $ 1,579,804 $ 1,466,667

4. LINES OF CREDIT

At March 1, 2014, the Company maintained two uncommitted lines of credit of $100 million each, with expiration dates of

September 2, 2014 and February 28, 2015, respectively. These uncommitted lines of credit are currently and are expected to be

used for letters of credit in the ordinary course of business. During fiscal 2013 and 2012, the Company did not have any direct

borrowings under the uncommitted lines of credit. As of March 1, 2014, there was approximately $4.5 million of outstanding

letters of credit. Although no assurances can be provided, the Company intends to renew both uncommitted lines of credit

before the respective expiration dates. In addition, as of March 1, 2014, the Company maintained unsecured standby letters of

credit of $74.3 million, primarily for certain insurance programs. As of March 2, 2013, there was approximately $11.6 million of

outstanding letters of credit and approximately $76.2 million of outstanding unsecured standby letters of credit, primarily for

certain insurance programs.

BED BATH & BEYOND 2013 ANNUAL REPORT

25