Bed, Bath and Beyond 2013 Annual Report Download - page 70

Download and view the complete annual report

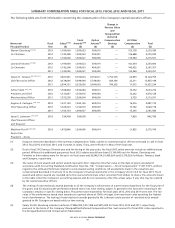

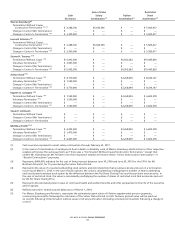

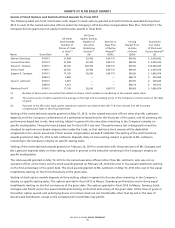

Please find page 70 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Messrs. Eisenberg and Feinstein’s unvested option awards are scheduled to vest as follows: (a) 8,480 on May 10, 2014, (b) 7,227 on

each of May 10, 2014 and 2015, and (c) 7,481 on each of May 10, 2014 and 2016 and 7,480 on May 10, 2015.

(3) Mr. Temares’ unvested option awards are scheduled to vest as follows: (a) 59,222 on May 11, 2014, (b) 52,786 on each of May 10,

2014 and 2015, (c) 50,880 on each of May 10, 2014, 2015 and 2016, (d) 49,869 on each of May 10, 2014 and 2016 and 49,870 on

each of May 10, 2015 and 2017, and (e) 60,591 on each of May 10, 2014, 2015, 2016 and 2017 and 60,592 on May 10, 2018.

(4) Messrs. Stark, Castagna and Fiorilli’s unvested option awards are scheduled to vest as follows: (a) 5,000 on May 10, 2014, (b) 8,206

on each of May 12, 2014 and 2015, (c) 8,933 on each of May 11, 2014, 2015 and 2016, (d) 6,420 on May 10, 2014 and 6,421 on

May 10, 2015, (e) 6,105 on May 10, 2014 and 6,106 on each of May 10, 2015 and 2016, (f) 5,204 on each of May 10, 2014, 2015, 2016

and 2017, and (g) 5,386 on each of May 10, 2014, 2015, 2016, 2017 and 2018.

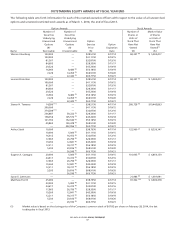

(5) Messrs. Eisenberg and Feinstein’s unvested stock awards are scheduled to vest as follows: (a) 14,120 on May 11, 2014, (b) 6,637 on

May 10, 2014 and 6,638 on May 10, 2015, (c) 5,339 on May 10, 2014 and 5,340 on each of May 10, 2015 and 2016, (d) 4,354 on each

of May 10, 2014, 2016 and 2017 and 4,353 on May 10, 2015, and (e) based on the Company’s achievement of a performance-based

test for the fiscal year of the grant, 4,299 on each of May 10, 2014 and 2016 and 4,300 on each of May 10, 2015, 2017 and 2018.

(6) Mr. Temares’ unvested stock awards are scheduled to vest as follows: (a) 24,709 on May 11, 2014, (b) 19,912 on each of May 10,

2014 and 2015, (c) 18,600 on each of May 10, 2014 and 2016, and 18,599 on May 10, 2015, (d) 17,414 on each of May 10, 2014,

2015, 2016 and 2017, and (e) based on the Company’s achievement of a performance-based test for the fiscal year of the grant,

19,348 on each of May 10, 2014, 2015, 2016, 2017 and 2018.

(7) Mr. Stark’s unvested stock awards are scheduled to vest as follows: (a) 4,865 on May 10, 2014, (b) 6,085 on each of May 12, 2014

and 2015, (c) 7,060 on each of May 11, 2014, 2015 and 2016, (d) 5,531 on each of May 10, 2014, 2015, 2016 and 2017, (e) 4,449 on

each of May 10, 2014 and 2016 and 4,450 on each of May 10, 2015, 2017 and 2018, (f) 3,918 on each of May 10, 2015, 2016, 2017

and 2018 and 3,919 on May 10, 2019, and (g) based on the Company’s achievement of a performance-based test for the fiscal year

of the grant, 4,156 on each of May 10, 2014, 2015 and 2017 and 4,157 on each of May 10, 2016 and 2018.

(8) Mr. Castagna’s unvested stock awards are scheduled to vest as follows: (a) 3,649 on May 10, 2014, (b) 4,563 on May 12, 2014 and

4,564 on May 12, 2015, (c) 5,295 on each of May 11, 2014, 2015 and 2016, (d) 4,425 on each of May 10, 2014, 2015, 2016 and 2017,

(e) 3,559 on May 10, 2014 and 3,560 on each of May 10, 2015, 2016, 2017 and 2018, (f) 3,192 on each of May 10, 2015 and 2017 and

3,193 on each of May 10, 2016, 2018 and 2019, (g) based on the Company’s achievement of a performance-based test for the fiscal

year of the grant, 3,439 on May 10, 2014 and 3,440 on each of May 10, 2015, 2016, 2017 and 2018, and (h) 736 on each of

February 26, 2015 and 2017 and 737 on each of February 26, 2016, 2018 and 2019.

(9) Ms. Lattmann’s unvested stock awards are scheduled to vest as follows: (a) 973 on May 10, 2014, (b) 1,217 on each of May 12, 2014

and 2015, (c) 1,412 on each of May 11, 2014, 2015 and 2016, (d) 885 on each of May 10, 2014, 2015, 2016 and 2017, (e) 712 on each

of May 10, 2014, 2015, 2016, 2017 and 2018, (f) 580 on each of May 10, 2015 and 2017 and 581 on each of May 10, 2016, 2018 and

2019, (g) 573 on each of May 10, 2016, 2017 and 2019 and 574 on each of May 10, 2018 and 2020, and (h) 294 on each of

February 26, 2015 and 2017 and 295 on each of February 26, 2016, 2018 and 2019.

(10) Mr. Fiorilli’s unvested stock awards are scheduled to vest as follows: (a) 3,649 on May 10, 2014, (b) 4,563 on May 12, 2014 and 4,564

on May 12, 2015, (c) 5,295 on each of May 11, 2014, 2015 and 2016, (d) 4,425 on each of May 10, 2014, 2015, 2016 and 2017,

(e) 3,559 on May 10, 2014 and 3,560 on each of May 10, 2015, 2016, 2017 and 2018, (f) 3,192 on each of May 10, 2015 and 2017 and

3,193 on each of May 10, 2016, 2018 and 2019, and (g) based on the Company’s achievement of a performance-based test for the

fiscal year of the grant, 3,439 on May 10, 2014 and 3,440 on each of May 10, 2015, 2016, 2017 and 2018.

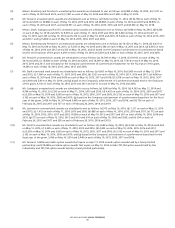

(11) Mr. Temares’ 14,286 exercisable option awards that expire on April 17, 2014 include option awards held by a family limited

partnership; and 374,288 exercisable option awards that expire on May 12, 2016 include 187,144 option awards held by him

individually and 187,144 option awards held by a family limited partnership.

BED BATH & BEYOND PROXY STATEMENT

68