Bed, Bath and Beyond 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

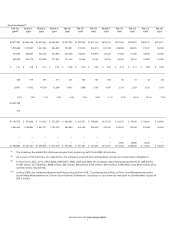

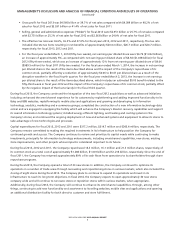

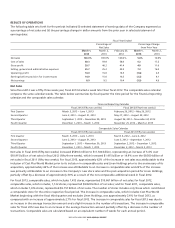

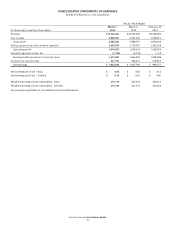

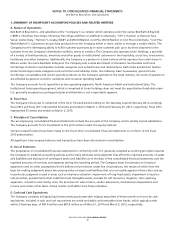

The Company has contractual obligations consisting mainly of operating leases for stores, offices, distribution facilities and

equipment, purchase obligations, long-term sale/leaseback and capital lease obligations and other long-term liabilities which

the Company is obligated to pay as of March 1, 2014 as follows:

(in thousands) Total Less than 1 year 1 − 3 years 4 − 5 years After 5 years

Operating lease obligations

(1)

$3,249,546 $ 563,973 $974,162 $713,392 $ 998,019

Purchase obligations

(2)

1,118,369 1,118,369 — — —

Long-term sale/leaseback and capital

lease obligations

(3)

342,386 9,827 19,787 20,014 292,758

Other long-term liabilities

(4)

466,741 — — — —

Total Contractual Obligations $5,177,042 $1,692,169 $993,949 $733,406 $1,290,777

(1)

The amounts presented represent the future minimum lease payments under non-cancelable operating leases. In addition to minimum rent,

certain of the Company’s leases require the payment of additional costs for insurance, maintenance and other costs. These additional

amounts are not included in the table of contractual commitments as the timing and/or amounts of such payments are not known. As of

March 1, 2014, the Company has leased sites for 21 locations planned for opening in fiscal 2014 or 2015, for which aggregate minimum

rental payments over the term of the leases are approximately $76.5 million and are included in the table above.

(2)

Purchase obligations primarily consist of purchase orders for merchandise.

(3)

Long-term sale/leaseback and capital lease obligations represent future minimum lease payments under the sale/leaseback agreements and

capital lease agreements.

(4)

Other long-term liabilities are primarily comprised of income taxes payable, deferred rent, workers’ compensation and general liability

reserves and various other accruals and are recorded as Deferred Rent and Other Liabilities and Income Taxes Payable in the Consolidated

Balance Sheet as of March 1, 2014. The amounts associated with these other long-term liabilities have been reflected only in the Total

Column in the table above as the timing and/or amount of any cash payment is uncertain.

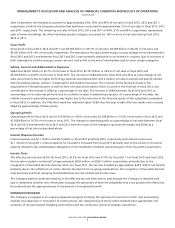

SEASONALITY

The Company’s sales exhibit seasonality with sales levels generally higher in the calendar months of August, November and

December, and generally lower in February.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past year. There

can be no assurance, however, that the Company’s operating results will not be affected by inflation in the future.

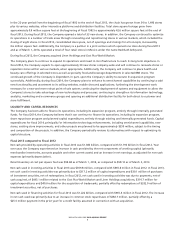

CRITICAL ACCOUNTING POLICIES

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires

the Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the

reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on historical

experience and on other assumptions that it believes to be relevant under the circumstances, the results of which form the

basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources.

In particular, judgment is used in areas such as inventory valuation, impairment of long-lived assets, goodwill and other

indefinite lived intangible assets, accruals for self insurance, litigation, store opening, expansion, relocation and closing costs,

stock-based compensation and income and certain other taxes. Actual results could differ from these estimates.

Inventory Valuation: Merchandise inventories are stated at the lower of cost or market. Inventory costs are primarily

calculated using the weighted average retail inventory method.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are calculated by

applying a cost-to-retail ratio to the retail values of inventories. The cost associated with determining the cost-to-retail ratio

includes: merchandise purchases, net of returns to vendors, discounts and volume and incentive rebates; inbound freight

expenses; duty, insurance and commissions.

BED BATH & BEYOND 2013 ANNUAL REPORT

11