Bed, Bath and Beyond 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

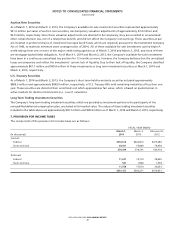

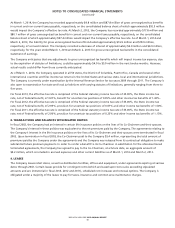

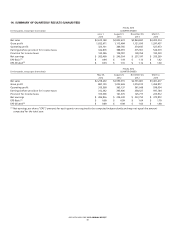

As of March 1, 2014, future minimum lease payments under non-cancelable operating leases were as follows:

Fiscal Year:

Operating Leases

(in thousands)

2014 $ 563,973

2015 515,364

2016 458,798

2017 390,422

2018 322,970

Thereafter 998,019

Total future minimum lease payments $3,249,546

Expenses for all operating leases were $559.8 million, $536.1 million and $456.2 million for fiscal 2013, 2012 and 2011, respectively.

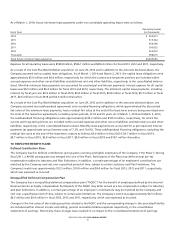

As a result of the Cost Plus World Market acquisition on June 29, 2012 and in addition to the amounts disclosed above, the

Company assumed various capital lease obligations. As of March 1, 2014 and March 2, 2013, the capital lease obligations were

approximately $3.9 million and $4.4 million, respectively, for which the current and long-term portions are included within

accrued expenses and other current liabilities and deferred rent and other liabilities, respectively, in the consolidated balance

sheet. Monthly minimum lease payments are accounted for as principal and interest payments. Interest expense for all capital

leases was $0.5 million and $0.4 million for fiscal 2013 and 2012, respectively. The minimum capital lease payments, including

interest, by fiscal year are: $0.9 million in fiscal 2014, $0.8 million in fiscal 2015, $0.8 million in fiscal 2016, $0.7 million in fiscal

2017, $0.6 million in fiscal 2018 and $2.6 million thereafter.

As a result of the Cost Plus World Market acquisition on June 29, 2012 and in addition to the amounts disclosed above, the

Company assumed two sale/leaseback agreements and recorded financing obligations, which approximated the discounted

fair value of the minimum lease payments, had a residual fair value at the end of the lease term and are being amortized over

the term of the respective agreements, including option periods, of 32 and 35 years. As of March 1, 2014 and March 2, 2013,

the sale/leaseback financing obligations were approximately $105.3 million and $105.9 million, respectively, for which the

current and long-term portions are included within accrued expenses and other current liabilities and deferred rent and other

liabilities, respectively, in the consolidated balance sheet. Monthly lease payments are accounted for as principal and interest

payments (at approximate annual interest rates of 7.2% and 10.6%). These sale/leaseback financing obligations, excluding the

residual fair value at the end of the lease term, mature as follows: $0.6 million in fiscal 2014, $0.7 million in fiscal 2015,

$0.7 million in fiscal 2016, $0.8 million in fiscal 2017, $0.8 million in fiscal 2018 and $78.1 million thereafter.

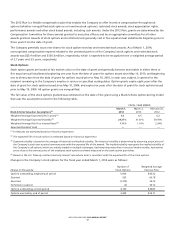

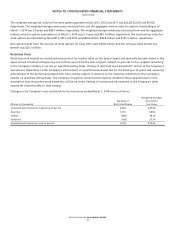

10. EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company has five defined contribution savings plans covering all eligible employees of the Company (‘‘the Plans’’). During

fiscal 2011, a 401(k) savings plan was merged into one of the Plans. Participants of the Plans may defer annual pre-tax

compensation subject to statutory and Plan limitations. In addition, a certain percentage of an employee’s contributions are

matched by the Company and vest over a specified period of time, subject to certain statutory and Plan limitations. The

Company’s match was approximately $12.5 million, $10.9 million and $9.4 million for fiscal 2013, 2012 and 2011, respectively,

which was expensed as incurred.

Nonqualified Deferred Compensation Plan

The Company has a nonqualified deferred compensation plan (‘‘NQDC’’) for the benefit of employees defined by the Internal

Revenue Service as highly compensated. Participants of the NQDC may defer annual pre-tax compensation subject to statutory

and plan limitations. In addition, a certain percentage of an employee’s contributions may be matched by the Company and

vest over a specified period of time, subject to certain plan limitations. The Company’s match was approximately $0.5 million,

$0.5 million and $0.4 million in fiscal 2013, 2012 and 2011, respectively, which was expensed as incurred.

Changes in the fair value of the trading securities related to the NQDC and the corresponding change in the associated liability

are included within interest income and selling, general and administrative expenses respectively, in the consolidated

statements of earnings. Historically, these changes have resulted in no impact to the consolidated statements of earnings.

BED BATH & BEYOND 2013 ANNUAL REPORT

31