Bed, Bath and Beyond 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Auction Rate Securities

As of March 1, 2014 and March 2, 2013, the Company’s available-for-sale investment securities represented approximately

$51.0 million par value of auction rate securities, less temporary valuation adjustments of approximately $3.3 million and

$2.0 million, respectively. Since these valuation adjustments are deemed to be temporary, they are recorded in accumulated

other comprehensive loss, net of a related tax benefit, and did not affect the Company’s net earnings. These securities at par

are invested in preferred shares of closed end municipal bond funds, which are required, pursuant to the Investment Company

Act of 1940, to maintain minimum asset coverage ratios of 200%. All of these available-for-sale investments carried triple-A

credit ratings from one or more of the major credit rating agencies as of March 1, 2014 and March 2, 2013, and none of them

are mortgage-backed debt obligations. As of March 1, 2014 and March 2, 2013, the Company’s available-for-sale investments

have been in a continuous unrealized loss position for 12 months or more, however, the Company believes that the unrealized

losses are temporary and reflect the investments’ current lack of liquidity. Due to their lack of liquidity, the Company classified

approximately $47.7 million and $49.0 million of these investments as long term investment securities at March 1, 2014 and

March 2, 2013, respectively.

U.S. Treasury Securities

As of March 1, 2014 and March 2, 2013, the Company’s short term held-to-maturity securities included approximately

$489.3 million and approximately $449.9 million, respectively, of U.S. Treasury Bills with remaining maturities of less than one

year. These securities are stated at their amortized cost which approximates fair value, which is based on quoted prices in

active markets for identical instruments (i.e., Level 1 valuation).

Long Term Trading Investment Securities

The Company’s long term trading investment securities, which are provided as investment options to the participants of the

nonqualified deferred compensation plan, are stated at fair market value. The values of these trading investment securities

included in the table above are approximately $39.7 million and $28.3 million as of March 1, 2014 and March 2, 2013, respectively.

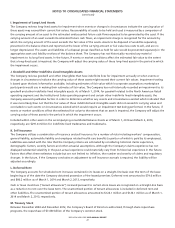

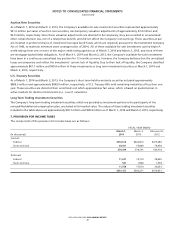

7. PROVISION FOR INCOME TAXES

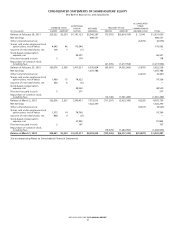

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

(in thousands)

March 1,

2014

March 2,

2013

February 25,

2012

Current:

Federal $514,818 $522,812 $475,280

State and local 64,581 55,889 74,438

579,399 578,701 549,718

Deferred:

Federal 11,221 15,710 28,695

State and local 537 1,860 1,538

11,758 17,570 30,233

$591,157 $596,271 $579,951

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

BED BATH & BEYOND 2013 ANNUAL REPORT

28