Bed, Bath and Beyond 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

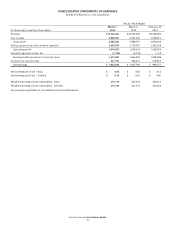

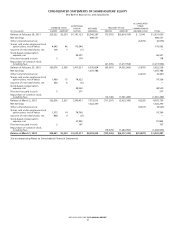

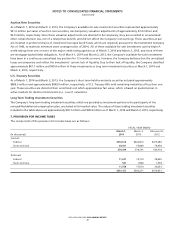

FISCAL YEAR ENDED

(in thousands)

March 1,

2014

March 2,

2013

February 25,

2012

Cash Flows from Operating Activities:

Net earnings $ 1,022,290 $ 1,037,788 $ 989,537

Adjustments to reconcile net earnings to net cash

provided by operating activities:

Depreciation 218,809 194,728 183,873

Stock-based compensation 56,244 47,163 45,223

Tax benefit from stock-based compensation 12,846 13,217 63

Deferred income taxes 11,841 17,600 30,238

Other (1,784) 702 (1,622)

(Increase) decrease in assets, net of effect of acquisitions:

Merchandise inventories (112,742) (198,407) (102,983)

Trading investment securities (11,382) (6,206) (4,538)

Other current assets (4,923) (43,585) 24,948

Other assets (3,829) (9,685) 900

Increase (decrease) in liabilities, net of effect of acquisitions:

Accounts payable 178,132 105,251 31,582

Accrued expenses and other current liabilities (13,532) (26,412) 19,822

Merchandise credit and gift card liabilities 32,735 36,888 16,585

Income taxes payable (4,502) 6,598 (37,392)

Deferred rent and other liabilities 2,983 17,350 29,048

Net cash provided by operating activities 1,383,186 1,192,990 1,225,284

Cash Flows from Investing Activities:

Purchase of held-to-maturity investment securities (1,156,634) (730,976) (1,605,851)

Redemption of held-to-maturity investment securities 1,117,500 1,031,249 1,456,250

Redemption of available-for-sale investment securities —31,715 28,975

Capital expenditures (317,180) (314,682) (243,374)

Investment in unconsolidated joint venture (3,436) ——

Payment for acquisitions, net of cash acquired —(643,098) —

Payment for acquisition of trademarks —(40,000) —

Net cash used in investing activities (359,750) (665,792) (364,000)

Cash Flows from Financing Activities:

Proceeds from exercise of stock options 54,815 56,377 171,088

Excess tax benefit from stock-based compensation 7,289 5,021 5,163

Payment for credit facility assumed in acquisition —(25,511) —

Repurchase of common stock, including fees (1,283,995) (1,001,280) (1,217,956)

Net cash used in financing activities (1,221,891) (965,393) (1,041,705)

Net decrease in cash and cash equivalents (198,455) (438,195) (180,421)

Cash and cash equivalents:

Beginning of period 564,971 1,003,166 1,183,587

End of period $ 366,516 $ 564,971 $ 1,003,166

See accompanying Notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Bed Bath & Beyond Inc. and Subsidiaries

BED BATH & BEYOND 2013 ANNUAL REPORT

19