Bed, Bath and Beyond 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Executive Summary

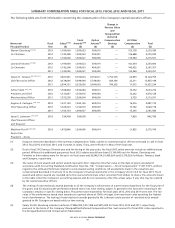

Committee Actions in Fiscal 2013. The Compensation Committee deliberated and determined the compensation programs

for the named executive officers described below during the spring of 2013, culminating in the adjustment of salaries and

awards of equity compensation made on May 10, 2013. At that time, the most recent Annual Meeting of Shareholders had

been held June 22, 2012 and included a vote where approximately 94% of the Company’s shareholders voting on the say-on-

pay proposal approved the compensation of the Company’s named executive officers for the then most recently completed

fiscal year ending on February 25, 2012. Given the strong approval of the say-on-pay proposal, the compensation decisions

made in the spring of 2013 did not include any structural changes to the Company’s policies or programs.

• Consistent with its prior practice, in fiscal 2013, the Compensation Committee continued to award performance-based

restricted stock and stock options with substantial time vesting, and did not implement a short term cash bonus program,

because it believes that equity compensation incentivizes executives to remain with the Company and focus on creating real,

long-term value for the Company’s shareholders more effectively than annual cash bonuses.

• For fiscal 2013, for the group of named executive officers whose compensation was determined by the Compensation

Committee in the spring of 2013, approximately 65% of their total compensation was in the form of equity awards vesting,

in most cases, over a period of five years. Of that group determined in the spring of 2013, 59% of their equity compensation

was in the form of performance-based restricted stock, and 41% was in the form of stock options.

• Ms. Lattmann, who was promoted to her current position in February 2014, was not part of the group of named executive

officers whose compensation was determined by the Compensation Committee in the spring of 2013.

• Based on the recommendation of the Compensation Committee, the Board of Directors amended the employment

agreements of Messrs. Eisenberg and Feinstein to eliminate their ability to terminate employment following a change in

control and receive change in control severance payments and benefits. Under the amendment, the executives may receive

severance payments and benefits in the event of the executives’ termination of employment without cause or due to a

constructive termination without cause, in each case, upon or within the two-year period following a change in control.

Shareholder Outreach and Engagement in Fiscal 2013. At the Company’s Annual Meeting of Shareholders held on June 28,

2013, approximately 78% of the shareholders voting on the say-on-pay proposal approved the compensation of our named

executive officers for the fiscal year ending on March 2, 2013. While the 2013 approval rate for the compensation of our

named executive officers for fiscal 2012 indicated continuing shareholder support, in light of the decline in the percentage of

approval votes between the 2012 and 2013 Annual Meetings, members of the Compensation and Nominating and Corporate

Governance Committees, together with senior management, embarked on an effort to gather feedback from key outside

shareholders regarding our executive compensation programs and decisions made in 2013 as follows:

• The Company contacted holders of approximately 56% of the Company’s outstanding shares, and Committee members,

together with members of management, met or spoke with holders of approximately 61% of the shares held by the

shareholders who had been contacted, or approximately 34% of outstanding shares, to obtain their views and suggestions

with respect to executive compensation and corporate governance matters.

• During the course of this outreach, management spoke with shareholders representing approximately an additional 18% of

outstanding shares, who indicated no current interest in engaging on these issues.

• Shareholders representing approximately an additional 4% of outstanding shares did not respond to our outreach.

• The results of these discussions were then shared with the full Board of Directors.

As part of this effort, the Compensation and the Nominating and Corporate Governance Committees also reviewed and

considered feedback from proxy advisory services firms, analyzed market practices at peer companies, engaged in discussions

with management and received advice from the independent compensation consultant and the Committees’ legal counsel,

including their independent counsel.

Changes Made in Fiscal 2014 in Response to Shareholder Feedback. Members of the Compensation Committee and members

of the Nominating and Governance Committee, with members of management, discussed various compensation and

governance matters with the Company’s shareholders, with the structure of the Company’s equity incentive programs being

the most common topic raised by the Company’s shareholders. As a result of this outreach to and engagement with the

Company’s shareholders and other feedback, the Board of Directors and the Compensation Committee took the following key

actions, among others, to address the views of our shareholders and to reflect the results of their own review and analysis:

BED BATH & BEYOND PROXY STATEMENT

51