Bed, Bath and Beyond 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

68

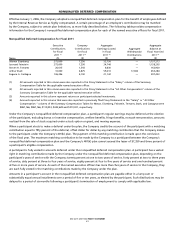

Amendment and Termination

Subject to the rules referred to in the balance of this paragraph, the Board of Directors or an authorized Committee consisting

solely of two or more non-employee directors may at any time amend, in whole or in part, any or all of the provisions of the

2012 Plan, or suspend or terminate it entirely, retroactively or otherwise. Except to correct obvious drafting errors or as required

to comply with applicable law or accounting rules, no such amendment may reduce the rights of a participant with respect

to awards previously granted without the consent of such participant. In addition, without the approval of shareholders, no

amendment may be made that would: increase the aggregate number of shares of common stock that may be issued under

the 2012 Plan to continue to comply with Section 162(m) of the Code, Section 422 of the Code or to satisfy applicable Nasdaq

rules.

Nontransferability

Except as the Committee may permit, at the time of grant or thereafter, awards granted under the 2012 Plan are not

transferable by a participant other than by will or the laws of descent and distribution. Shares of common stock acquired by a

permissible transferee will continue to be subject to the terms of the 2012 Plan and the applicable award agreement.

Because future awards under the 2012 Plan will be based upon prospective factors including the nature of services to be

rendered and a participant’s potential contributions to the success of the Company or its affiliates, actual awards cannot be

determined at this time.

The following discussion of the principal U.S. federal income tax consequences with respect to options under the 2012 Plan

is based on statutory authority and judicial and administrative interpretations as of the date of this proxy statement, which

are subject to change at any time (possibly with retroactive effect) and may vary in individual circumstances. Therefore, the

following is designed to provide a general understanding of the federal income tax consequences (state, local and other tax

consequences are not addressed below). This discussion is limited to the U.S. federal income tax consequences to individuals

who are citizens or residents of the U.S., other than those individuals who are taxed on a residence basis in a foreign country.

The U.S. federal income tax law is technical and complex and the discussion below represents only a general summary.

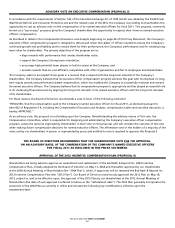

THE FOLLOWING SUMMARY IS INCLUDED HEREIN FOR GENERAL INFORMATION ONLY AND DOES NOT PURPORT

TO ADDRESS ALL THE TAX CONSIDERATIONS THAT MAY BE RELEVANT.

EACH RECIPIENT OF A GRANT IS URGED TO CONSULT HIS OR HER OWN TAX ADVISOR AS TO THE SPECIFIC TAX

CONSEQUENCES TO SUCH RECIPIENT OF THE GRANT AND THE DISPOSITION OF COMMON STOCK.

Non-qualified Stock Options. In general, an optionee will recognize no taxable income upon the grant of a non-qualified

stock option and the Company will not receive a deduction at the time of such grant. Upon exercise of a non-qualified stock

option, an optionee generally will recognize ordinary income in an amount equal to the excess of the fair market value of the

common stock on the date of exercise over the exercise price. Upon a subsequent sale of the common stock by the optionee,

the optionee will recognize short-term or long-term capital gain or loss, depending upon his holding period for the common

stock. Subject to the limitations of Section 162(m) of the Code and Section 280G of the Code (as described below), the Company

will generally be allowed a deduction equal to the amount recognized by the optionee as ordinary income.