Bed, Bath and Beyond 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

38

Patrick R. Gaston, 54, is the CEO and founder of Gastal Networks, LLC, a consulting firm specializing in corporate social

responsibility initiatives, since January 2012. From January to December 2011, he served a one-year term as Executive in Residence

and Senior Advisor with the Clinton Bush Haiti Fund to support the rebuilding efforts in Haiti. Until January 2011, Mr. Gaston

was President of the Verizon Foundation since 2003. Prior to assuming that position, Mr. Gaston held a variety of management

positions at Verizon Communications Inc. and its predecessors since 1984, including positions in operations, marketing, human

resources, strategic planning and government relations. He has been a director of the Company since 2007. Among other

things, Mr. Gaston brings to the Board experience with respect to very large and complex public companies as well as extensive

experience with other local, national and international organizations through his non-profit work.

Jordan Heller, 51, has been President of Heller Wealth Advisors LLC, a provider of financial advisory services, since 2008. Mr. Heller

was previously a partner with The Schonbraun McCann Group LLP from 2005 to 2008. Prior to joining The Schonbraun McCann

Group, Mr. Heller was a Managing Director at American Economic Planning Group. He has been a director of the Company

since 2003. Among other things, Mr. Heller brings to the Board experience in and knowledge of various financial matters. He

is a certified public accountant, chartered financial analyst and Certified Financial Planner , and serves as an “audit committee

financial expert” on the Company’s Audit Committee.

Victoria A. Morrison, 59, has been the Executive Vice President & General Counsel of Edison Properties, LLC, a diversified real

estate company, since 2007. Ms. Morrison was previously practicing law as a partner in the law firm of Riker, Danzig, Scherer,

Hyland & Perretti LLP since 1986. She has been a director of the Company since 2001. Among other things, Ms. Morrison brings to

the Board experience in and knowledge of real estate law and transactions.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ELECTION

OF THE NINE NOMINEES AS DIRECTORS.

OTHER BOARD OF DIRECTORS INFORMATION

How many times did the Board of Directors meet last year?

The Board of Directors held five meetings during the fiscal year ended February 25, 2012 (“fiscal 2011”).

Director Attendance

Each director of the Company attended 100% of the total number of meetings of the Board of Directors and committees on

which he or she served. The Company encourages, but does not require, the directors to attend the Company’s Annual Meeting

of Shareholders. All of the Company’s current directors attended the 2011 Annual Meeting of Shareholders.

How were directors compensated for fiscal 2011?

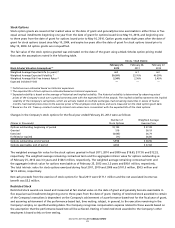

The following table provides compensation information for each member of our Board of Directors during fiscal 2011, other than

Warren Eisenberg, Leonard Feinstein and Steven H. Temares, each of whom is a named executive officer of the Company and

none of whom received any additional compensation for his service as a director of the Company.

Annual director fees for fiscal 2011 were $75,000. In addition, directors serving on standing committees of the Board of Directors

were paid as follows: an additional $10,000 for Audit Committee members, an additional $7,500 for Compensation Committee

members, and (other than for the Lead Director) an additional $5,000 for Nominating and Corporate Governance Committee

members. The Lead Director received an additional $15,000 for acting in that capacity. Director fees are paid on a quarterly

basis. Directors have the right to elect to receive all or fifty percent of their fees in stock or cash. In addition to the fees above,

each director received an automatic grant of restricted stock under the Company’s 2004 Incentive Compensation Plan with a fair

market value on the date of the Company’s Annual Meeting of Shareholders during such fiscal year (the average of the high and

low trading prices on such date) equal to $75,000, such restricted stock to vest on the first trading day following the expiration of

any applicable blackout period following the last day of the fiscal year of grant provided that the director remains in office until

the last day of the fiscal year. The following table provides director compensation information for fiscal 2011.

™