Bed, Bath and Beyond 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

66

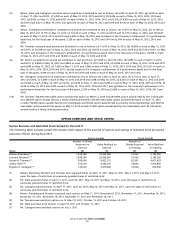

Awards under the 2012 Plan

Stock Options. The 2012 Plan authorizes the Committee to grant ISOs (only to eligible employees) and non-qualified stock

options to purchase shares of common stock. The Committee will determine the number of shares of common stock subject

to each option, the term of each option, the exercise price (which may not be less than the fair market value of the common

stock at the time of grant, or 110% of fair market value in the case of ISOs granted to 10% shareholders), any vesting schedule,

and the other material terms of each option. Options will be exercisable at such times and subject to such terms as are

determined by the Committee at grant. The maximum term of options under the 2012 Plan is eight years (or five years in the

case of ISOs granted to 10% shareholders). Options with vesting conditions based on the attainment of performance goals will

be exercisable no earlier than one year after grant and options with vesting conditions based on the continued service of the

recipient will be fully exercisable no earlier than three years after grant (permitting pro-rata vesting over such three year

period), subject to acceleration of vesting in the event of a change in control, retirement, death or disability, at the discretion

of the Committee. However, up to 5% of the shares reserved for issuance may be granted without these minimum vesting

requirements. Upon the exercise of an option, the participant must make payment of the full exercise price, either: in cash,

broker reasonably acceptable to the Company to deliver promptly to the Company an amount equal to the aggregate purchase

relinquishment of options or by payment in full or in part in the form of common stock).

Stock Appreciation Rights. The 2012 Plan authorizes the Committee to grant SARs either in tandem with an option or

independent of an option. The exercise price of a tandem SAR will be the exercise price of the related option. A SAR is a right

to receive a payment either in cash or common stock equal in value to the excess of the fair market value of one share of

common stock on the date of exercise over the exercise price per share of the SAR. The Committee will determine the terms

and conditions of SARs at the time of grant, but generally SARs will be subject to the same terms and conditions as options (as

described above).

Restricted Stock Awards. The 2012 Plan authorizes the Committee to grant restricted stock awards. Recipients of restricted

stock awards enter into an agreement with the Company subjecting the restricted stock awards to transfer and other

restrictions and providing the criteria or dates on which such awards vest and such restrictions lapse. The restrictions on

restricted stock awards may lapse and the awards may vest over time, based on performance criteria or other factors (including,

without limitation, performance goals that are intended to comply with the performance-based compensation exception

under Section 162(m) of the Code), as determined by the Committee at grant. For restricted stock awards that vest or whose

restrictions lapse based on the attainment of performance goals, the minimum restriction or vesting period will be no less

than one year after grant, and for restricted stock awards that vest or whose restrictions lapse based on the continued service

of the recipient, the restriction or vesting period will be no less than three years after grant (permitting restrictions to lapse

or awards to vest pro-rata over such three year period), subject to the earlier vesting or lapsing of restrictions in the event

of a change in control, retirement, death or disability, as the discretion of the Committee. However, up to 5% of the shares

reserved for issuance may be granted without these minimum vesting requirements or restriction periods. Except as otherwise

determined by the Committee, a holder of a restricted stock award has all of the attendant rights of a stockholder including

the right to receive dividends, if any, subject to vesting conditions as described below, the right to vote shares and, subject to

and conditioned upon the vesting and restrictions lapsing for all of shares, the right to tender such shares. The right to receive

dividends on a restricted stock award is subject to the vesting or lapsing of the restrictions on the restricted stock award.

Performance Awards. The 2012 Plan authorizes the Committee to grant performance awards entitling participants to receive

a fixed number of shares of common stock or cash, as determined by the Committee, upon the attainment of performance

goals with respect to a designated performance period. Unless the Committee determines otherwise at grant, the minimum

performance period will be one year.