Bed, Bath and Beyond 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

48

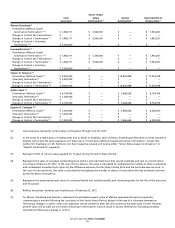

Consistent with the Company’s practice since fiscal 2008, stock option awards are made in dollars (with the number of shares

covered by the options determined by dividing the dollar amount of the grant by the Stock Option Fair Value, as described

below). The Compensation Committee believes that making stock option awards in dollar amounts rather than share amounts

is advisable because making stock option awards in dollar amounts allows the Compensation Committee to align stock option

awards with the value of the option grants. Making stock option awards in dollars also enables the Compensation Committee

to more readily evaluate appropriate aggregate compensation amounts and percentage increases or decreases for executives,

in comparison to making stock option awards in share amounts (the value of which varies depending on the trading price of

the Company’s stock and other factors). In making the awards, the Compensation Committee considered the fair value of these

options on the date of grant determined in accordance with Accounting Standards Codification Topic No. 718, “Compensation -

Stock Compensation” (the “Stock Option Fair Value”).

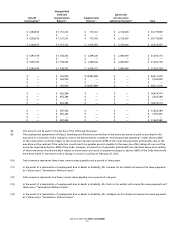

All awards of restricted stock and stock options are made under the Company’s 2004 Incentive Compensation Plan, approved by

the Company’s shareholders (the performance goals under such plan having been re-approved in 2009), which is the only equity

incentive plan under which the Company can currently make awards of equity compensation. As described below under Proposal

4, “Approval of the 2012 Incentive Compensation Plan,” the Company is requesting shareholder approval of the Company’s 2012

Incentive Compensation Plan, which is an amendment and restatement of the Company’s 2004 Incentive Compensation Plan.

Among other things, the 2012 Incentive Compensation Plan increases the maximum aggregate number of shares of common

stock available under such plan, extends the plan’s term until 2022 and incorporates certain key corporate governance best

practices, all of which are subject to approval by the Company’s shareholders.

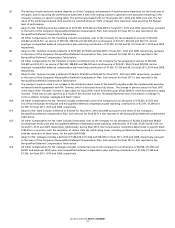

Senior Executive Compensation

In addition to considering the Company’s compensation policies generally, the Compensation Committee reviews executive

compensation and concentrates on the compensation packages for the Company’s senior executive officers, namely, the

Co-Chairmen (Warren Eisenberg and Leonard Feinstein, who are the Company’s Co-Founders) and the Chief Executive Officer

(Steven H. Temares), believing that these three named executive officers are the most important and influential in determining

the continued success of the Company. The Company has enjoyed considerable success in the 20 years it has been a public

company, and in both fiscal 2010 and fiscal 2011 achieved strong financial results.

Fiscal 2011 executive compensation decisions were made effective May 10, 2011, before the initial advisory vote on executive

compensation took place at the 2011 annual meeting of shareholders held on June 23, 2011. At that meeting, approximately

75% of shares present and eligible to vote approved the compensation paid to the Company’s named executive officers, which

the Committee considered generally favorable. In making inquiries of certain shareholders that did not approve the executive

compensation at the 2011 annual meeting of shareholders, the Company learned that such shareholder decisions did not relate to

the compensation arrangements set forth in the summary compensation table for fiscal 2010.

For fiscal 2011, the base salaries for the Co-Chairmen remained at $1,100,000, the same as they were for the prior five fiscal years.

For fiscal 2011, the base salary for Mr. Temares increased by $500,000 to $3,000,000. The Compensation Committee determined

that Mr. Temares’ base salary increase was warranted based on the Company’s strong financial performance and Mr. Temares’

strong individual performance. According to the analysis prepared by JFR, Mr. Temares’ increased base salary for fiscal 2011 was

below the median of the cash compensation of the 18-company peer group.

For fiscal 2011, the base salary for Mr. Stark increased by $125,000 and the base salary for Mr. Castagna increased by $160,000.

The Compensation Committee determined that these increases were warranted based on the Company’s growth and strong

financial results in 2010 and based on the results and recommendations of JFR’s compensation review discussed above.

The aggregate equity awards to Mr. Temares for fiscal 2011 increased from fiscal 2010 by $1,225,000 to $10,225,000, with the

increase comprised of $500,000 in stock options and $725,000 in performance-based restricted stock. Of the total of $10,225,000

of equity awards to Mr. Temares for fiscal 2011, $5,225,000 consisted of performance-based restricted stock (based on the market

value of the Company’s common stock on the date of grant) and $5,000,000 consisted of stock options (based on the Stock

Option Fair Value). The equity awards to Messrs. Eisenberg and Feinstein for fiscal 2011 remained unchanged from fiscal 2010 at

$2,000,000 for each such executive, comprised of $1,500,000 of performance-based restricted stock and $500,000 of stock options

(valued on the same basis as Mr. Temares’ awards).

The aggregate equity awards to each of Mr. Stark and Mr. Castagna for fiscal 2011 increased from 2010 by $52,678, comprised

entirely of an increase in the dollar amount of stock option grants, with no change in the dollar amount of performance-based

restricted stock awards from fiscal 2010.