Bed, Bath and Beyond 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2011 ANNUAL REPORT

16

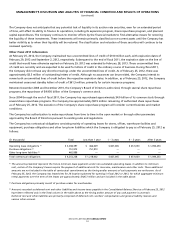

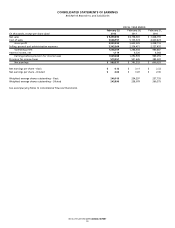

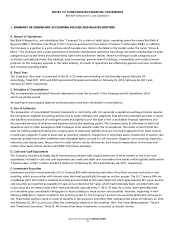

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Bed Bath & Beyond Inc. and Subsidiaries

ACCUMULATED

ADDITIONAL TREASURY OTHER

COMMON STOCK PAID-IN RETAINED STOCK COMPREHENSIVE

(in thousands) SHARES AMOUNT CAPITAL EARNINGS SHARES AMOUNT INCOME (LOSS) TOTAL

Balance at February 28, 2009 314,678 $ 3,147 $ 878,568 $ 4,154,921 (54,977) $ (2,031,642) $ (4,540) $ 3,000,454

Comprehensive Income (Loss):

Net earnings 600,033 600,033

Change in temporary impairment

of auction rate securities,

net of taxes 325 325

Pension adjustment, net of taxes 1,260 1,260

Currency translation adjustment 3,683 3,683

Comprehensive Income 605,301

Shares sold under employee stock

option plans, net of taxes 4,503 45 96,431 96,476

Issuance of restricted shares, net 1,369 14 (14) —

Stock-based compensation

expense, net 45,411 45,411

Director fees paid in stock 3 119 119

Repurchase of common stock,

including fees (2,678) (94,857) (94,857)

Balance at February 27, 2010 320,553 3,206 1,020,515 4,754,954 (57,655) (2,126,499) 728 3,652,904

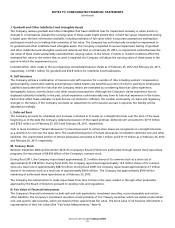

Comprehensive Income (Loss):

Net earnings 791,333 791,333

Change in temporary impairment

of auction rate securities,

net of taxes (663) (663)

Pension adjustment, net of taxes 343 343

Currency translation adjustment 4,692 4,692

Comprehensive Income 795,705

Shares sold under employee stock

option plans, net of taxes 3,804 38 125,058 125,096

Issuance of restricted shares, net 863 9 (9) —

Stock-based compensation

expense, net 45,465 45,465

Director fees paid in stock 2 94 94

Repurchase of common stock,

including fees (15,901) (687,605) (687,605)

Balance at February 26, 2011 325,222 3,253 1,191,123 5,546,287 (73,556) (2,814,104) 5,100 3,931,659

Comprehensive Income (Loss):

Net earnings 989,537 989,537

Change in temporary impairment

of auction rate securities,

net of taxes (297) (297)

Pension adjustment, net of taxes (4,596) (4,596)

Currency translation adjustment (2,086) (2,086)

Comprehensive Income 982,558

Shares sold under employee stock

option plans, net of taxes 4,645 46 179,546 179,592

Issuance of restricted shares, net 706 7 (7) —

Stock-based compensation

expense, net 46,501 46,501

Director fees paid in stock 3 174 174

Repurchase of common stock,

including fees (21,505) (1,217,956) (1,217,956)

Balance at February 25, 2012 330,576 $ 3,306 $ 1,417,337 $ 6,535,824 (95,061) $ (4,032,060) $ (1,879) $ 3,922,528

See accompanying Notes to Consolidated Financial Statements.