Bed, Bath and Beyond 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

59

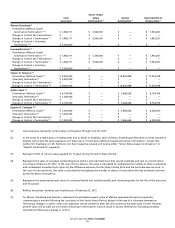

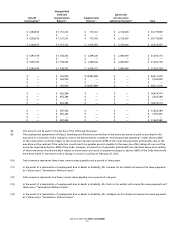

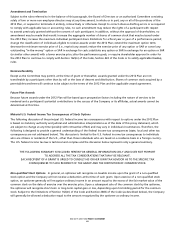

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

The following table sets forth information for each of the named executive officers with respect to the value of all unexercised

options and unvested restricted stock awards as of February 25, 2012, the end of fiscal 2011.

Option Awards Stock Awards

Number Number of Number of Market Value

of Securities Securities Shares or of Shares

Underlying Underlying Units of or Units of

Unexercised Unexercised Option Stock That Stock That

Options Options Exercise Option Have Not Have Not

(#) (#) Price Expiration Vested Vested (2)

Name Exercisable Unexercisable ($) Date (#) ($)

Warren Eisenberg 71,811 0 $37.5100 4/20/13 131,620 (6) $7,943,267

100,000 0 $38.5150 4/17/14

100,000 0 $41.1150 5/10/15

81,367 0 $32.8700 5/12/16

56,402 28,201 (3) $28.3300 5/11/17

9,776 19,550 (3) $45.2000 5/10/18

0 25,440 (3) $56.1850 5/10/19

Leonard Feinstein 71,810 0 $37.5100 4/20/13 131,620 (6) $7,943,267

100,000 0 $38.5150 4/17/14

100,000 0 $41.1150 5/10/15

81,367 0 $32.8700 5/12/16

56,402 28,201 (3) $28.3300 5/11/17

9,776 19,550 (3) $45.2000 5/10/18

0 25,440 (3) $56.1850 5/10/19

Steven H. Temares 80,000 0 $38.2200 4/25/13 287,652 (7) $17,359,798

320,000 (1) 0 $38.7650 4/25/13

300,000 (10) 0 $41.3450 3/03/14

200,000 0 $37.5100 4/20/13

200,000 (10) 0 $38.5150 4/17/14

160,000 40,000 (4) $41.1150 5/10/15

224,572 (10) 149,716 (4) $32.8700 5/12/16

118,443 177,666 (4) $28.3300 5/11/17

52,786 211,144 (4) $45.2000 5/10/18

0 254,400 (4) $56.1850 5/10/19

Arthur Stark 0 5,000 (5) $37.5100 4/20/13 135,125 (8) $8,154,794

0 10,000 (5) $38.7950 4/17/14

0 15,000 (5) $41.1150 5/10/15

0 32,824 (5) $32.8700 5/12/16

0 44,664 (5) $28.3300 5/11/17

6,420 25,681 (5) $45.2000 5/10/18

0 30,528 (5) $56.1850 5/10/19

Eugene A. Castagna 100,000 0 $41.3450 3/03/14 105,029 (9) $6,338,500

0 5,000 (5) $37.5100 4/20/13

15,000 10,000 (5) $38.7950 4/17/14

10,000 15,000 (5) $41.1150 5/10/15

8,205 32,824 (5) $32.8700 5/12/16

0 44,664 (5) $28.3300 5/11/17

6,420 25,681(5) $45.2000 5/10/18

0 30,528

(5) $56.1850 5/10/19

(1)

These options represent a portion of Mr. Temares’ April 25, 2003 grant, the exercise price of which was increased in order to comply

with Section 409A of the Code following the Company’s 2006 review of its equity grants and procedures.

(2) Market value is based on the closing price of the Company’s common stock of $60.35 per share on February 24, 2012, the last trading

day in fiscal 2011.

(3) Messrs. Eisenberg and Feinstein’s unvested option awards are scheduled to vest as follows: (a) 28,201 on May 11, 2012, (b) 9,775 on

each of May 10, 2012 and 2013, and (c) 8,480 on each of May 10, 2012, 2013 and 2014.

(4) Mr. Temares’ unvested option awards are scheduled to vest as follows: (a) 40,000 on May 10, 2012, (b) 74,858 on each of May 12,

2012 and 2013, (c) 59,222 on each of May 11, 2012, 2013 and 2014, (d) 52,786 on each of May 10, 2012, 2013, 2014 and 2015, and (e)

50,880 on each of May 10, 2012, 2013, 2014, 2015 and 2016.