Bed, Bath and Beyond 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

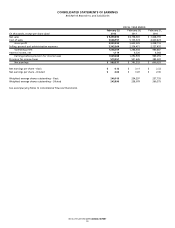

BED BATH & BEYOND 2011 ANNUAL REPORT

25

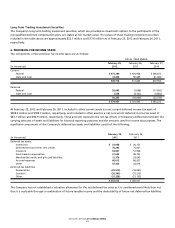

Long Term Trading Investment Securities

The Company’s long term trading investment securities, which are provided as investment options to the participants of the

nonqualified deferred compensation plan, are stated at fair market value. The values of these trading investment securities

included in the table above are approximately $22.1 million and $17.6 million as of February 25, 2012 and February 26, 2011,

respectively.

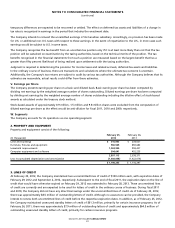

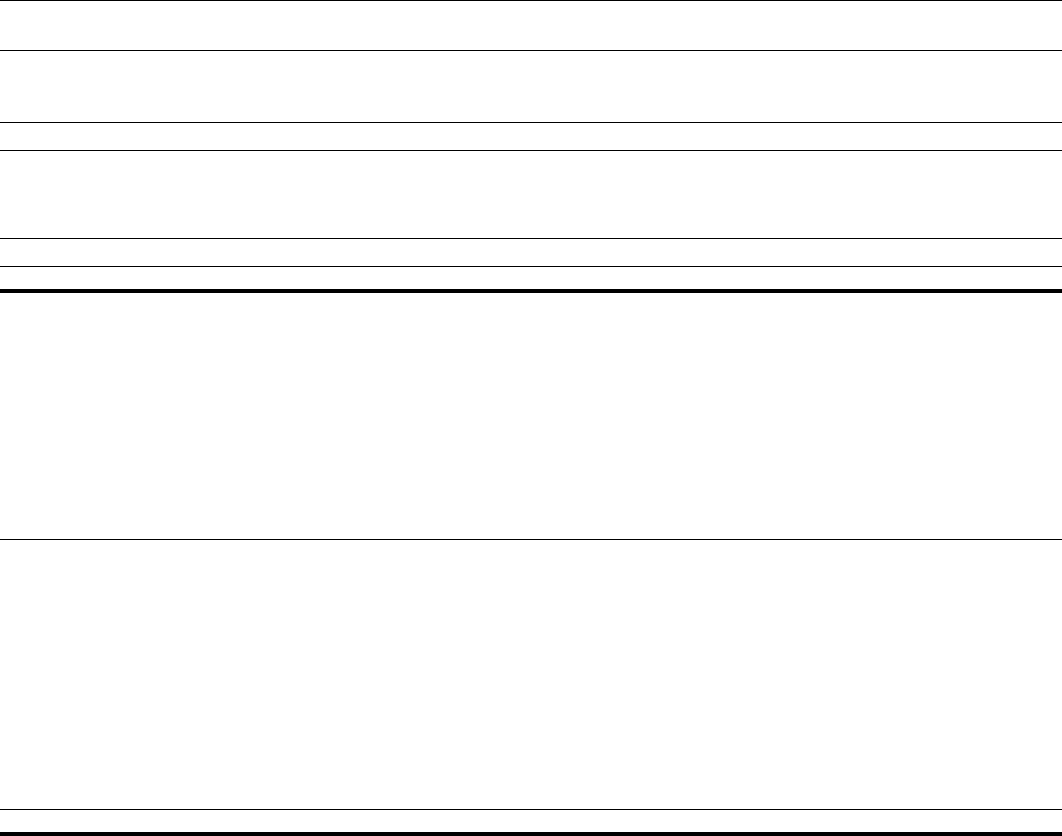

6. PROVISION FOR INCOME TAXES

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

February 25, February 26, February 27,

(in thousands) 2012 2011 2010

Current:

Federal $ 475,280 $ 426,956 $ 346,875

State and local 74,438 90,689 61,080

549,718 517,645 407,955

Deferred:

Federal 28,695 (7,698) (17,851)

State and local 1,538 (8,302) (4,882)

30,233 (16,000) (22,733)

$ 579,951 $ 501,645 $ 385,222

At February 25, 2012 and February 26, 2011, included in other current assets is a net current deferred income tax asset of

$209.4 million and $189.1 million, respectively, and included in other assets is a net noncurrent deferred income tax asset of

$43.7 million and $90.9 million, respectively. These amounts represent the net tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The

significant components of the Company’s deferred tax assets and liabilities consist of the following:

February 25, February 26,

(in thousands) 2012 2011

Deferred tax assets:

Inventories $ 33,058 $ 26,151

Deferred rent and other rent credits 78,292 75,007

Insurance 53,607 51,906

Stock-based compensation 37,633 48,743

Merchandise credits and gift card liabilities 12,376 29,043

Accrued expenses 80,012 86,927

Other 47,422 33,616

Deferred tax liabilities:

Depreciation (25,510) (18,991)

Goodwill (36,590) (31,213)

Other (27,228) (21,152)

$ 253,072 $ 280,037

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not

that it is realizable through a combination of future taxable income and the deductibility of future net deferred tax liabilities.