Bed, Bath and Beyond 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2011 ANNUAL REPORT

29

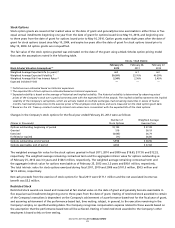

Stock Options

Stock option grants are issued at fair market value on the date of grant and generally become exercisable in either three or five

equal annual installments beginning one year from the date of grant for options issued since May 10, 2010, and beginning one

to three years from the date of grant for options issued prior to May 10, 2010. Option grants expire eight years after the date of

grant for stock options issued since May 10, 2004, and expire ten years after the date of grant for stock options issued prior to

May 10, 2004. All option grants are nonqualified.

The fair value of the stock options granted was estimated on the date of the grant using a Black-Scholes option-pricing model

that uses the assumptions noted in the following table.

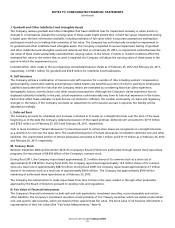

FISCAL YEAR ENDED

February 25, February 26, February 27,

Black-Scholes Valuation Assumptions (1) 2012 2011 2010

Weighted Average Expected Life (in years) (2) 6.2 6.1 6.3

Weighted Average Expected Volatility (3) 30.59% 33.70% 40.39%

Weighted Average Risk Free Interest Rates (4) 2.34% 2.56% 2.45%

Expected Dividend Yield — — —

(1) Forfeitures are estimated based on historical experience.

(2) The expected life of stock options is estimated based on historical experience.

(3) Expected volatility is based on the average of historical and implied volatility. The historical volatility is determined by observing actual

prices of the Company’s stock over a period commensurate with the expected life of the awards. The implied volatility represents the implied

volatility of the Company’s call options, which are actively traded on multiple exchanges, had remaining maturities in excess of twelve

months, had market prices close to the exercise prices of the employee stock options and were measured on the stock option grant date.

(4) Based on the U.S. Treasury constant maturity interest rate whose term is consistent with the expected life of the stock options.

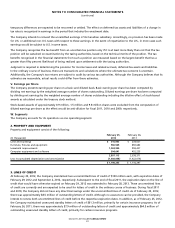

Changes in the Company’s stock options for the fiscal year ended February 25, 2012 were as follows:

Number of Weighted Average

(Shares in thousands) Stock Options Exercise Price

Options outstanding, beginning of period 10,135 $ 37.08

Granted 519 56.19

Exercised (4,645) 36.79

Forfeited or expired (11) 36.80

Options outstanding, end of period 5,998 $ 38.96

Options exercisable, end of period 4,004 $ 37.84

The weighted average fair value for the stock options granted in fiscal 2011, 2010 and 2009 was $19.65, $17.05 and $12.33,

respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding as

of February 25, 2012 was 3.3 years and $128.5 million, respectively. The weighted average remaining contractual term and

the aggregate intrinsic value for options exercisable as of February 25, 2012 was 2.2 years and $90.1 million, respectively.

The total intrinsic value for stock options exercised during fiscal 2011, 2010 and 2009 was $101.5 million, $50.5 million and

$61.9 million, respectively.

Net cash proceeds from the exercise of stock options for fiscal 2011 were $171.1 million and the net associated income tax

benefit was $5.2 million.

Restricted Stock

Restricted stock awards are issued and measured at fair market value on the date of grant and generally become exercisable in

five equal annual installments beginning one to three years from the date of grant. Vesting of restricted stock awarded to certain

of the Company’s executives is dependent on the Company’s achievement of a performance-based test for the fiscal year of grant,

and assuming achievement of the performance-based test, time vesting, subject, in general, to the executive remaining in the

Company’s employ on specified vesting dates. The Company recognizes compensation expense related to these awards based on

the assumption that the performance-based test will be achieved. Vesting of restricted stock awarded to the Company’s other

employees is based solely on time vesting.