Bed, Bath and Beyond 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2011 ANNUAL REPORT

28

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

10. COMMITMENTS AND CONTINGENCIES

The Company maintains employment agreements with its Co-Chairmen, which extend through June 2013. The agreements

provide for a base salary (which may be increased by the Board of Directors), termination payments, postretirement benefits

and other terms and conditions of employment. In addition, the Company maintains employment agreements with other

executives which provide for severance pay and, in some instances, certain other supplemental retirement benefits.

The Company records an estimated liability related to its various claims and legal actions arising in the ordinary course

of business when and to the extent that it concludes a liability is probable and the amount of the loss can be reasonably

estimated. Such estimated loss is based on available information and advice from outside counsel, where appropriate. As

additional information becomes available, the Company reassesses the potential liability related to claims and legal actions and

revises its estimated liabilities, as appropriate. The Company expects the ultimate disposition of these matters will not have a

material adverse effect on the Company’s consolidated financial position, results of operations or liquidity. The Company also

cannot predict the nature and validity of claims which could be asserted in the future, and future claims could have a material

impact on its earnings.

11. SUPPLEMENTAL CASH FLOW INFORMATION

The Company paid income taxes of $568.6 million, $487.4 million and $338.9 million in fiscal 2011, 2010 and 2009, respectively.

The Company recorded an accrual for capital expenditures of $28.8 million, $17.8 million and $21.7 million as of February 25,

2012, February 26, 2011 and February 27, 2010, respectively.

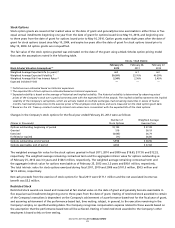

12. STOCK-BASED COMPENSATION

The Company measures all employee stock-based compensation awards using a fair value method and records such expense,

net of estimated forfeitures, in its consolidated financial statements. Currently, the Company’s stock-based compensation relates

to restricted stock awards and stock options. The Company’s restricted stock awards are considered nonvested share awards.

Stock-based compensation expense for the fiscal year ended February 25, 2012, February 26, 2011 and February 27, 2010 was

approximately $45.2 million ($28.5 million after tax or $0.12 per diluted share), approximately $44.3 million ($27.1 million after

tax or $0.10 per diluted share) and approximately $44.2 million ($26.9 million after tax or $0.10 per diluted share), respectively.

In addition, the amount of stock-based compensation cost capitalized for the years ended February 25, 2012 and February 26,

2011 was approximately $1.3 and $1.2 million, respectively.

Incentive Compensation Plans

The Company currently grants awards under the Bed Bath & Beyond 2004 Incentive Compensation Plan (the “2004 Plan”). The

2004 Plan is a flexible compensation plan that enables the Company to offer incentive compensation through stock options,

restricted stock awards, stock appreciation rights and performance awards, including cash awards. Under the 2004 Plan, grants

are determined by the Compensation Committee for those awards granted to executive officers and by an appropriate

committee for all other awards granted. Awards of stock options and restricted stock generally vest in five equal annual

installments beginning one to three years from the date of grant.

Prior to fiscal 2004, the Company had adopted various stock option plans (the “Prior Plans”), all of which solely provided for the

granting of stock options. Upon adoption of the 2004 Plan, the common stock available under the Prior Plans became available

for issuance under the 2004 Plan. No further option grants may be made under the Prior Plans, although outstanding awards

under the Prior Plans will continue to be in effect.

Under the 2004 Plan and the Prior Plans, an aggregate of 83.4 million shares of common stock were authorized for issuance.

The Company generally issues new shares for stock option exercises and restricted stock awards. As of February 25, 2012,

unrecognized compensation expense related to the unvested portion of the Company’s stock options and restricted stock

awards was $21.7 million and $108.4 million, respectively, which is expected to be recognized over a weighted average period

of 3.0 years and 3.8 years, respectively.