Bed, Bath and Beyond 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

61

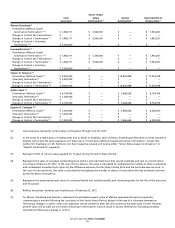

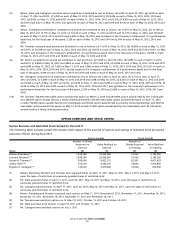

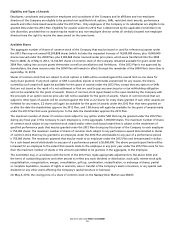

NONQUALIFIED DEFERRED COMPENSATION

Effective January 1, 2006, the Company adopted a nonqualified deferred compensation plan for the benefit of employees defined

by the Internal Revenue Service as highly compensated. A certain percentage of an employee’s contributions may be matched

by the Company, subject to certain plan limitations, as more fully described below. The following table provides compensation

information for the Company’s nonqualified deferred compensation plan for each of the named executive officers for fiscal 2011.

Nonqualified Deferred Compensation for Fiscal 2011

Executive Company Aggregate Aggregate

Contributions Contributions Earnings (Losses) Aggregate Balance at

for Fiscal for Fiscal in Fiscal Withdrawals/ Fiscal Year End

2011

(1) 2011

(2) 2011

(3) Distributions 2011

(4)

Name ($) ($) ($) ($) ($)

Warren Eisenberg 275,000 7,350 33,756 — 1,157,213

Leonard Feinstein 275,000 7,350 34,746 — 1,158,203

Steven H. Temares 26,615 1,543 6,630 — 162,920

Arthur Stark 10,000 4,875 59,210 17,832 653,284

Eugene A. Castagna 136,246 4,100 21,142 — 597,453

(1)

All amounts reported in this column were also reported in this Proxy Statement in the “Salary” column of the Summary

Compensation Table for the applicable named executive officer.

(2)

All amounts reported in this column were also reported in this Proxy Statement in the “All Other Compensation” column of the

Summary Compensation Table for the applicable named executive officer.

(3) Amounts reported in this column represent returns on participant-selected investments.

(4)

Amounts reported in this column that were also reported in previously filed Proxy Statements in the “Salary” or “All Other

Compensation “ columns of the Summary Compensation Tables for Messrs. Eisenberg, Feinstein, Temares, Stark, and Castagna were

$867,166, $867,166, $110,253, $452,628 and $373,031, respectively.

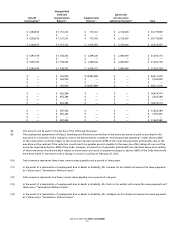

Under the Company’s nonqualified deferred compensation plan, a participant’s regular earnings may be deferred at the election

of the participant, excluding bonus or incentive compensation, welfare benefits, fringe benefits, noncash remuneration, amounts

realized from the sale of stock acquired under a stock option or grant, and moving expenses.

When a participant elects to make a deferral under the plan, the Company credits the account of the participant with a matching

contribution equal to fifty percent of the deferral, offset dollar for dollar by any matching contribution that the Company makes

to the participant under the Company’s 401(k) plan. The payment of this matching contribution is made upon the conclusion

of the fiscal year. The maximum matching contribution to be made by the Company to a participant between the Company’s

nonqualified deferred compensation plan and the Company’s 401(k) plan cannot exceed the lesser of $7,350 and three percent of

a participant’s eligible compensation.

A participant is fully vested in amounts deferred under the nonqualified deferred compensation plan. A participant has a vested

right in matching contributions made by the Company under the nonqualified deferred compensation plan, depending on the

participant’s years of service with the Company: twenty percent at one to two years of service, forty percent at two to three years

of service, sixty percent at three to four years of service, eighty percent at four to five years of service and one hundred percent

at five or more years of service. As each of the named executive officers has more than five years of service to the Company, they

are each fully vested in the matching contributions made by the Company under the plan.

Amounts in a participant’s account in the nonqualified deferred compensation plan are payable either in a lump sum or

substantially equal annual installments over a period of five or ten years, as elected by the participant. Such distributions may be

delayed to a period of six months following a participant’s termination of employment to comply with applicable law.