Bed, Bath and Beyond 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

63

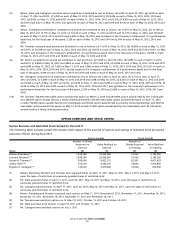

Increase the Aggregate Share Reserve. The current aggregate share reserve will be increased by an additional 14,300,000

shares for a total share reserve of 43,200,868 shares under the 2012 Plan (which represents the additional 14,300,000 shares, plus

19,000,000 shares reserved under the 2004 Plan plus 9,900,868 shares reserved under the plans in effect prior to adoption of the

2004 Plan and which were transferred to the 2004 Plan in 2004). We continue to maintain a “fungible share limit” where each

share of common stock subject to full value awards (e.g., restricted stock or restricted stock units) will be counted as 2.2 shares

against the aggregate share reserve under the 2012 Plan. Our Board of Directors believes that stock ownership by key employees,

consultants, officers and directors provides performance incentives and fosters long-term commitment to our benefit and the

benefit of our shareholders and that the proposed increase in the share reserve is necessary to insure that a sufficient reserve of

common stock remains available for issuance to allow us to continue to utilize equity incentives to attract and retain the services

of key individuals essential to our long-term growth and financial success.

Term Extension. We extended the term of the 2012 Plan through May 18, 2022, provided the requisite shareholder approval of

the 2012 Plan is obtained (currently the 2004 Plan is scheduled to expire on May 13, 2014).

Corporate Governance Best Practices. The 2012 Plan also adopts the following key features that are designed to protect our

shareholders’ interests and to reflect corporate governance best practices:

The 2012 Plan provides that the total number

of shares of common stock available for awards will be reduced by (i) the total number of stock options or stock

appreciation rights (“SARs”) that have been exercised, regardless of whether any of the shares of common stock

underlying such awards are not actually issued to the participant as the result of a net settlement and (ii) any shares

of common stock used to pay any exercise price or tax withholding obligation with respect to any stock option or SAR.

Further, the Company may not use the cash proceeds it receives from award exercises to repurchase shares of common

stock on the open market for reuse under the 2012 Plan.

The 2012 Plan ensures all equity-based awards will require at least a one year period

vesting period for awards where vesting is based on the attainment of performance goals and at least a three year

pro-rata vesting period for awards where vesting is based solely on continued service with the Company. Accelerated

vesting is permitted in the case of death, disability, retirement or change of control. Up to 5% of the maximum

available shares may be granted under the 2012 Plan without regard to the minimum vesting requirement.

We have clarified that dividend payments on restricted stock awards and other stock-based

awards will be deferred until, and conditioned upon, the lapsing of the restrictions on the award.

To enhance the Company’s flexibility in designing awards, the 2012 Plan has the ability to grant

incentive stock options (“ISOs”), which may provide the participant with the opportunity for favorable tax treatment under

Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), subject to certain conditions and requirements.

Although ISOs have been added to the 2012 Plan to provide future flexibility, we intend to continue our practice of granting non-

qualified stock options.

When calculating the previously approved performance goals

under Section 162(m) of the Code, the 2012 Plan has been amended to establish a default rule to exclude the impact of certain

events, occurrences or circumstances, such as: restructurings, discontinued operations, disposal of a business, extraordinary

In addition to the foregoing, shareholders are being asked to reapprove the Section 162(m) performance goals under the 2012

Plan so that certain incentive awards granted under the 2012 Plan to executive officers of the Company may qualify as exempt

performance–based compensation under Section 162(m) of the Code. Otherwise, Section 162(m) of the Code generally disallows