Bed, Bath and Beyond 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

64

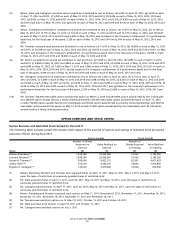

the corporate tax deduction for certain compensation paid in excess of $1,000,000 annually to each of the chief executive

officer and the three other most highly paid executive officers of publicly held companies (other than the chief financial officer),

unless compensation is “performance-based” or satisfies other conditions. Section 162(m) of the Code generally requires such

performance goals to be approved by shareholders every five years. If shareholders do not approve the 2012 Plan (including the

Section 162(m) performance goals) at the 2012 Annual Meeting, then awards granted under the 2004 Plan on or after the first

shareholder’s meeting in 2014 will not qualify as exempt performance-based compensation under Code Section 162(m), unless

such approval is obtained or shareholders approve other designated performance criteria at or prior to the first shareholders’

meeting in 2014. Notwithstanding the foregoing, awards of stock options and stock appreciation rights will continue to qualify as

exempt performance-based compensation under Section 162(m) of the Code through the remaining term of the 2004 Plan (i.e.,

May 13, 2014), even if the shareholders do not approve the 2012 Plan (including the Code Section 162(m) performance goals) at

or prior to the first shareholders’ meeting in 2014.

The Company anticipates filing a Registration Statement on Form S-8 with the Securities Exchange Commission to register the

additional amount of new shares of common stock to be included in the aggregate share reserve under the 2012 Plan as soon as

practicable following shareholder approval of the 2012 Plan.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS APPROVE THE PLAN

(INCLUDING REAPPROVAL OF THE PERFORMANCE GOALS UNDER THE 2012 PLAN).

IF THE REQUISITE SHAREHOLDER APPROVAL OF THE 2012 PLAN IS NOT OBTAINED, IT WILL NOT TAKE EFFECT

AND ALL PROVISIONS OF THE 2004 PLAN WILL REMAIN IN EFFECT.

Background of the Proposal to Approve the Amendment

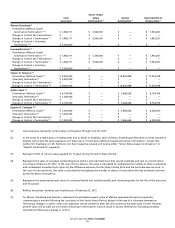

As of May 4, 2012, the closing price of shares of common stock as reported on Nasdaq was $68.05 per share. In addition, as of

May 4, 2012, stock options outstanding and shares available for grant under all of our equity compensation plans are as follows:

Total

Stock options outstanding, all plans (1) 5,353,624

Full-value awards outstanding, all plans 4,208,519

Shares available for awards, all plans (2) 13,142,601

(1) As of May 4, 2012, the range of the exercise prices of stock options outstanding under all of our equity compensation plans was $28.3300

to $56.1850, with weighted-average exercise price of $39.0833. The closing price of a share of common stock on such date was $68.05.

The weighted-average remaining contractual life of stock options outstanding under all of our equity compensation plans as of May 4,

2012 was 3.4 years.

(2) Represents shares of common stock reserved for issuance under all of our equity compensation plans as of May 4, 2012.

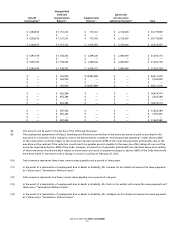

The following description of the 2012 Plan is a summary of its principal provisions and is qualified in its entirety by reference to

the 2012 Plan, which is attached as Exhibit A to this Proxy Statement.

DESCRIPTION OF THE 2012 PLAN

Administration

The Board of Directors has appointed two committees to administer the 2012 Plan: the Compensation Committee which is

Co-Chairmen and Chief Executive Officer, which is authorized to grant awards to other employees and consultants. All members

of the Compensation Committee are “non-employee directors” within the meaning of Rule 16b-3 under the Exchange Act,

“outside directors” within the meaning of Section 162(m) of the Code, “independent directors” under applicable Nasdaq rules or

other applicable securities exchange rules and will be “independent” pursuant to rules that may be enacted by the Securities and

Exchange Commission under The Dodd-Frank Wall Street Reform and Consumer Protection Act. Under the 2012 Plan, the Board

of Directors has the authority to grant awards to non-employee directors.