Bed, Bath and Beyond 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2011 ANNUAL REPORT

27

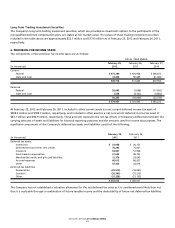

8. LEASES

The Company leases retail stores, as well as warehouses, office facilities and equipment, under agreements expiring at various

dates through 2041. Certain leases provide for contingent rents (which are based upon store sales exceeding stipulated amounts

and are immaterial in fiscal 2011, 2010 and 2009), scheduled rent increases and renewal options. The Company is obligated

under a majority of the leases to pay for taxes, insurance and common area maintenance charges.

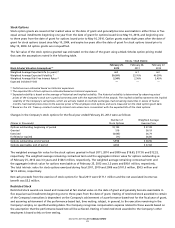

As of February 25, 2012, future minimum lease payments under non-cancelable operating leases are as follows:

Amount

Fiscal Year (in thousands)

2012 $ 466,029

2013 436,347

2014 390,718

2015 348,181

2016 302,869

Thereafter 1,094,253

Total future minimum lease payments $ 3,038,397

Expenses for all operating leases were $456.2 million, $442.2 million and $423.3 million for fiscal 2011, 2010 and 2009,

respectively.

9. EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company has three defined contribution savings plans covering all eligible employees of the Company (“the Plans”).

During fiscal 2011, a 401(k) savings plan was merged into one of the Plans. Participants of the Plans may defer annual pre-tax

compensation subject to statutory and Plan limitations. In addition, a certain percentage of an employee’s contributions

are matched by the Company and vest over a specified period of time, subject to certain statutory and Plan limitations. The

Company’s match was approximately $9.4 million, $8.6 million and $7.6 million for fiscal 2011, 2010 and 2009, respectively,

which was expensed as incurred.

Nonqualified Deferred Compensation Plan

The Company has a nonqualified deferred compensation plan (“NQDC”) for the benefit of employees defined by the Internal

Revenue Service as highly compensated. Participants of the NQDC may defer annual pre-tax compensation subject to statutory

and plan limitations. In addition, a certain percentage of an employee’s contributions may be matched by the Company and

vest over a specified period of time, subject to certain plan limitations. The Company’s match was approximately $0.4 million

for fiscal 2011, 2010 and 2009 which was expensed as incurred.

Changes in the fair value of the trading securities related to the NQDC and the corresponding change in the associated

liability are included within interest income and selling, general and administrative expenses respectively, in the consolidated

statements of earnings. Historically, these changes have resulted in no impact to the consolidated statements of earnings.

Defined Benefit Plan

The Company has a non-contributory defined benefit pension plan for the CTS employees, hired on or before July 31, 2003,

who meet specified age and length-of-service requirements. The benefits are based on years of service and the employee’s

compensation near retirement. The Company recognizes the overfunded or underfunded status of the pension plan as an asset

or liability in its statement of financial position and recognizes changes in the funded status in the year in which the changes

occur. For the years ended February 25, 2012, February 26, 2011 and February 27, 2010, the net periodic pension cost was not

material to the Company’s results of operations. The Company has a $14.6 million and $7.5 million liability, which is included

in deferred rent and other liabilities as of February 25, 2012 and February 26, 2011, respectively. In addition, as of February

25, 2012 and February 26, 2011, the Company recognized a loss of $3.9 million, net of taxes of $2.6 million, and a gain of $0.7

million, net of taxes of $0.4 million, respectively, within accumulated other comprehensive (loss) income.