Bed, Bath and Beyond 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

70

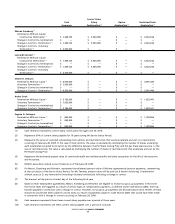

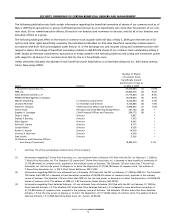

(1) During the Company’s fiscal year 2006, an independent committee of the Company’s Board of Directors identified various deficiencies

in the process of granting and documenting stock options and restricted shares, with the result, among other things, that for

purposes of Section 409A of the Code (“Section 409A”), certain stock options were deemed to have been granted with an exercise

price less than the value of underlying common stock on the date of grant. Under Section 409A, this would have subjected certain

stock options held by a significant number of the Company’s employees (including Messrs. Eisenberg, Feinstein, Temares, Stark and

Castagna) to adverse tax consequences unless brought into compliance with Section 409A. In order to effect such compliance, the

exercise price of certain options held by Messrs. Eisenberg, Feinstein and Temares was increased, and the exercise of certain options

held by Messrs. Stark and Castagna was limited to a specified calendar year (in all cases without any payment or other consideration

to the affected executive). As a consequence, individual option grants to Messrs. Eisenberg, Feinstein and Temares may appear in this

table as multiple entries where the exercise price was increased for only a portion of such grant, and, in the cases of Messrs. Stark

and Castagna, some grants appear with a December 31 expiration date where that year was selected as the latest year in which any

portion of such grant may be exercised.

(2) Market value is based on the closing price of the Company’s common stock of $21.30 per share on February 27, 2009, the last trading

day in fiscal year 2008.

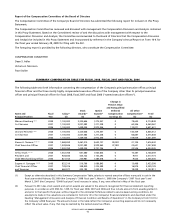

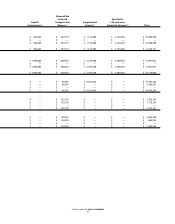

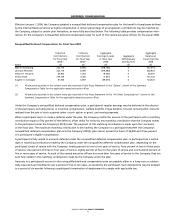

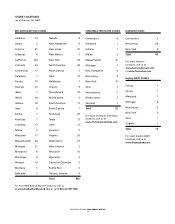

Options Exercised and Restricted Stock Vested for 2008

The following table includes certain information with respect to the exercise of options and vesting of restricted stock by named

executive officers during fiscal 2008.

Option Awards Stock Awards

Number of Shares Value Number of

Acquired Realized Shares Acquired Value Realized

on Exercise on Exercise on Vesting on Vesting

Name (#) ($) (#) ($)

Warren Eisenberg(1) 0 0 36,934 1,174,832

Leonard Feinstein(1) 0 0 36,934 1,174,832

Steven H. Temares(1) (4) 160,000 3,504,396 36,934 1,174,832

Arthur Stark(2) 0 0 3,199 102,550

Eugene A. Castagna(3) (5) 24,000 229,922 3,199 102,550

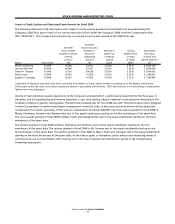

(1) Messrs. Eisenberg, Feinstein and Temares each acquired 12,797 shares with a market price of $32.06 on April 21, 2008, 12,463 shares

with a market price of $30.57 on April 17, 2008, and 11,674 shares with a market price of $32.87 on May 12, 2008 upon the lapse of

restrictions on previously granted shares of restricted stock.

(2) Mr. Stark acquired 3,199 shares with a market price of $32.06 on April 21, 2008, upon the lapse of restrictions on previously granted

shares of restricted stock.

(3) Mr.Castagna acquired 3,199 shares with a market price of $32.06 on April 21, 2008, upon the lapse of restrictions on previously

granted shares of restricted stock.

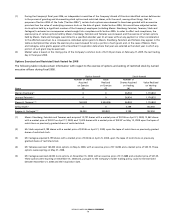

(4) Mr.Temares exercised 160,000 stock options on May 6, 2008, with an exercise price of $11.8282 and a market price of $33.73. These

options were expiring on May 27, 2008.

(5) Mr. Castagna exercised 24,000 stock options on November 13, 2008, with an exercise price of $11.4688 and a market price of $21.05.

These options were expiring on December 31, 2008 and, pursuant to the Company’s insider trading policy, could not be exercised

between November 21, 2008 and their expiration date.