Bed, Bath and Beyond 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

57

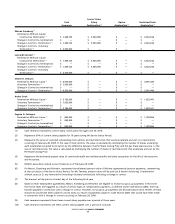

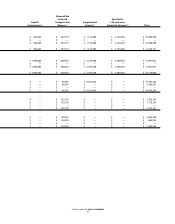

JFR advised that the aggregate compensation for Messrs. Eisenberg and Feinstein, as Co-Chairmen, and Mr. Temares, as Chief

Executive Officer, for the Company’s 2007 fiscal year was in the 73rd percentile of Peer Group 1. JFR also advised that the aggre-

gate recommended compensation for these top three named executives for fiscal 2008 was at the 73rd percentile of Peer Group 1

and the 61st percentile in a calculation which compared total senior executive compensation of the Peer Group 1 companies

against their latest fiscal year net income as a percentage of sales.

JFR further advised that the aggregate compensation for Mr. Temares for the Company’s 2007 fiscal year was in the 65th

percentile of Peer Group 1, and that the aggregate compensation for Messrs. Eisenberg and Feinstein (i.e., the combined

compensation for both of such executives) for fiscal 2007 was in the 88th percentile of Peer Group 2.

In addition to advising the Compensation Committee as to how the fiscal 2007 compensation of the Company’s named executive

officers compared to the compensation of executives in the peer groups in various different categories, JFR provided advice and

recommendations with respect to compensation levels for fiscal 2008. Taking into account such advice, the Committee determined

that the aggregate compensation for the Company’s top three named executive officers for fiscal 2008 should not exceed the

aggregate compensation for those executives for fiscal 2007. The Committee further determined that the respective compensation

of the Co-Chairmen and Mr. Temares, as the Chief Executive Officer, for fiscal 2008 should reflect the Company’s succession plan-

ning. As a result of this determination, and in light of analyses prepared by JFR, the Compensation Committee increased for fiscal

2008 the total compensation of the Chief Executive Officer and decreased the total compensation of the Co-Chairmen by approxi-

mately equal amounts.

Also for fiscal 2008, the Compensation Committee requested advice from JFR regarding the methodology for determining equity

compensation for the named executive officers and other key officers. Based upon advice from JFR, the Compensation Committee

deemed it advisable to modify its approach to granting stock option awards by determining the compensation allocated to these

awards in dollars as compared to its approach in prior years of determining these awards based on the number of shares covered

by the options. Accordingly, the Compensation Committee made aggregate and individual compensation determinations, includ-

ing each element of compensation, in dollars. The Compensation Committee also requested advice from JFR regarding the

methodology for computing the number of option share grants based on dollar-denominated awards of stock option grants as

described under “Senior Executive Compensation.”

In making its determinations for the current fiscal year (fiscal 2009), the Committee continued the engagement of JFR to conduct

acompensation review for the named executive officers and certain other executives. Under the direction of the Committee,

the compensation review included a peer group competitive market review and total compensation recommendations by JFR.

In reaching its compensation determinations for fiscal 2009, the Committee took into account both the Company’s very strong

performance during fiscal 2008 as compared to the companies in its Peer Group 1 and the fact that, although the Company

performed strongly compared to its peers, the Company’s net income and stock price declined considerably during fiscal 2008

compared to fiscal 2007. In a comparison with companies in Peer Group 1, the Company ranked in the 85th percentile in total

shareholder return for fiscal 2008 and in the 99th percentile in terms of net income as a percentage of sales. In addition, during

fiscal 2008, the Company saw its principal direct competitor file for bankruptcy protection and liquidate as it was unable to

withstand the difficult operating environment in the sector in which the Company was able to continue to effectively compete.

The Committee also recognized that, although the Company had performed well on a relative basis, the Company’s total

shareholder returnfor fiscal 2008 was negative 24.8% and its net earnings for fiscal 2008 declined approximately 24.5%

compared to 2007, due in significant part to the economic crisis affecting the housing sector and retail generally. Taking into

account the foregoing factors and advice from JFR, the Committee determined that the aggregate compensation for all of the

Company’s named executive officers for fiscal 2009 should remain the same as the aggregate compensation for those executives

for fiscal 2008.

In connection with its fiscal 2009 compensation review, the Committee determined that it would use only Peer Group 1 as a refer-

ence peer group; the Committee concluded that Peer Group 2 did not provide sufficient meaningful incremental data to warrant

continued use of two separate peer groups for comparison purposes.

The Compensation Committee solicits input from the Co-Chairmen when considering decisions concerning the compensation of

the Chief Executive Officer, and solicits input from the Co-Chairmen and the Chief Executive Officer when considering decisions

concerning the compensation of the other named executive officers and any other executive whose compensation the Committee

determines. In connection with its determinations in the spring of 2008 and 2009, the Committee consulted with the Co-Chairmen,

who arethe Co-Founders of the Company and who have been continuously involved in the affairs of the Company since its organ-

ization in 1971, with respect to the recommendations of JFR regarding the compensation package of the Chief Executive Officer.

The Committee also received and reviewed the recommendations of the Co-Chairmen and Chief Executive Officer regarding the

proposed salary and equity compensation awards for the other named executive officers and certain other executives for fiscal

2008 and 2009. In addition, JFR met with the Co-Chairmen to discuss compensation recommendations.