Bed, Bath and Beyond 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

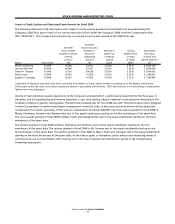

59

InterActive, J.C. Penney, Kohl’s, Limited Brands, Lowe’s, Macy’s, Nordstrom, Office Depot, Office Max, Radio Shack, Sears, Sherwin-

Williams, Staples, Target, Tiffany & Co. and TJX Companies. In fiscal 2008, the S&P 500 Retailing Index did not include: Circuit City,

Dillard’s, IAC InterActive and Office Max.

In making its determinations for fiscal 2009 and in light of macroeconomic factors that have resulted in substantial volatility and

uncertainty in the retail sector, the Committee decided to follow the same performance-based tests used in fiscal 2008. However,

the Committee determined that, as it continues to monitor retail sector performance in the coming months, it would undertake a

comprehensive review of all of the Company’s compensation programs for named executive officers and other key executives,

including performance-based compensation, in connection with its fiscal 2010 compensation review.

All executives (other than those discussed above) and associates awarded incentive compensation receive grants consisting solely

of restricted stock. Vesting of restricted stock awarded to these employees is based solely on time-vesting with no performance-

based test.

All awards of restricted stock and stock options are made under the Company’s 2004 Incentive Compensation Plan, approved

by the Company’s shareholders, which is the only equity incentive plan under which the Company can currently make awards of

equity compensation.

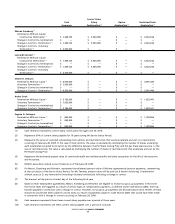

Senior Executive Compensation

In addition to considering the Company’s compensation policies generally, the Compensation Committee reviews executive com-

pensation and concentrates on the compensation packages for the Company’s named executive officers, namely, the Co-Chairmen

(Warren Eisenberg and Leonard Feinstein, who are the Company’s Co-Founders) and the Chief Executive Officer (Steven H.

Temares), believing that these three named executive officers are the most important and influential in determining the contin-

ued success of the Company. The Company has enjoyed considerable success in the 17 years it has been a public company, with,

until the challenging economic environment in fiscal 2008, revenue and earnings per share growth in each year since its initial

public offering in 1992.

Cash compensation of the three senior executives has been held to comparatively modest levels when compared with companies

of comparable size and earnings. The base salaries of the Co-Chairmen for fiscal 2009 are $1,100,000, the same as they were for

the prior three years. The base salary of the Chief Executive Officer for fiscal 2009 is $1,500,000, the same as it was for fiscal 2008.

His base salarywas increased in annual increments of $100,000 for fiscal 2006 and 2007 and in fiscal 2008 was increased by

$150,000. No cash bonuses were paid.

In each of fiscal years 2006 and 2007, the Compensation Committee awarded stock options (in addition to restricted stock) to

the named executive officers since stock options reward the named executive officers only if shareholder values are increased.

In each such year,the stock option awards were 200,000 shares to the Chief Executive Officer and 100,000 shares to each of the

Co-Chairmen. In making the awards in these number of shares, the Committee considered the fair value of these options

determined in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 123, “Accounting for Stock-Based

Compensation” or SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”). In addition, in each such year, the

Compensation Committee awarded shares of restricted stock having a market value on the date of grant of $2,400,000 to each

of the Chief Executive Officer and the Co-Chairmen.

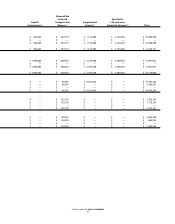

As described above, the Compensation Committee determined that for fiscal 2008 there should be no increase in aggregate

compensation for the top three named executive officers, with a reallocation of compensation among such officers such that

the total compensation of the Chief Executive Officer was increased in an amount approximately equal to a reduction in total

compensation of the Co-Chairmen. Consequently, the aggregate equity awards to Mr. Temares for fiscal 2008 were increased from

fiscal 2007 by $1,600,000 to $7,000,000 (valued by the Committee as described below). The increase to Mr. Temares was comprised

entirely of stock options. Of the total of $7,000,000 of equity awards to Mr. Temares for fiscal 2008, $2,400,000 consisted of

restricted stock (based on the market value of the Company’s common stock on the date of grant) and $4,600,000 consisted of

stock options (based on the fair value determined on the date of grant in accordance with SFAS No. 123R [“Stock Option Fair

Value”]).

The equity awards to Messrs. Eisenberg and Feinstein for fiscal 2008 were decreased from fiscal 2007 by an aggregate of

$1,800,000 to $3,000,000 for each such executive, of which $2,000,000 consisted of restricted stock and $1,000,000 consisted of

stock options (valued on the same basis as Mr. Temares’ awards).