Bed, Bath and Beyond 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

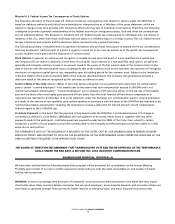

BED BATH & BEYOND PROXY STATEMENT

45

The Board’s proposals with respect to the election of directors by a majority vote in non-contested elections and the related

director resignation policy and the elimination of supermajority voting provisions are described below. The Board’s actions with

respect to the adoption of a policy on the recovery of incentive compensation, or “clawback policy,” shareholder called special

meetings and advisory votes on compensation practices, or “say on pay,” are described above under the heading “Corporate

Governance Enhancements.”

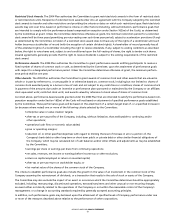

Certain Relationships and Related Transactions

On March 22, 2007, the Company acquired buybuy BABY, a retailer of infant and toddler merchandise, for approximately $67 mil-

lion (net of cash acquired) and repayment of debt of approximately $19 million. buybuy BABY was founded in 1996 by Richard

and Jeffrey Feinstein, both of whom were previously employed by the Company, and are the sons of Leonard Feinstein, one of the

Company’s Co-Chairmen. The aforementioned repayment of approximately $19 million of debt resulted in the retirement of all

indebtedness of buybuy BABY, which debt was held by Richard and Jeffrey Feinstein (approximately $16 million) and Leonard

Feinstein (approximately $3 million). The Company believes that such transaction and the related agreements were comparable to

terms the Company could have obtained from an unrelated third party.

The Company’s Audit Committee, among other things, reviews and approves, on an annual basis and as otherwise appropriate,

any proposed related party transactions. The members of the Audit Committee also consult with the Company’s independent

auditors to ensure that the Committee considers all transactions which the auditors advise may involve transactions with related

persons. The Audit Committee’s determinations with respect to all related party transactions are recorded in the minutes of the

Audit Committee, and the Audit Committee’s responsibility to review and approve related party transactions is set forth in the

Audit Committee’scharter.

In connection with the acquisition of buybuy BABY, the Board of Directors of the Company determined to appoint a Special

Committee, consisting solely of independent directors (one member of the Audit Committee and two members of both the

Compensation Committee and Nominating and Corporate Governance Committee), with full power and authority of the Special

Committee to make conclusive determinations with respect to all matters relating to the acquisition, including, without limitation,

the determination whether to enter into such transaction, the consideration, any employment or other arrangements with the

principals of buybuy BABY,and other terms and conditions. The Special Committee engaged independent legal counsel and inde-

pendent financial advisors and received an opinion from such financial advisors that the consideration paid by the Company

(including the debt repayment referred to above) was fair. The Company’s Co-Chairmen, Leonard Feinstein and Warren Eisenberg,

recused themselves from deliberations relating to the transaction.

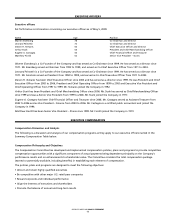

RATIFICATION OF APPOINTMENT OF AUDITORS (PROPOSAL 2)

Who has been appointed as the Auditors?

The Audit Committee has appointed KPMG LLP to serve as our independent auditors for fiscal 2009, subject to ratification by

our shareholders. Representatives of KPMG LLP will be present at the Annual Meeting to answer questions. They will also have

the opportunity to make a statement if they desireto do so. If the proposal to ratify their appointment is not approved, other

certified public accountants will be considered by the Audit Committee. Even if the proposal is approved, the Audit Committee,

in its discretion, may direct the appointment of new independent auditors at any time during the year if it believes that such a

change would be in the best interest of the Company and its shareholders.

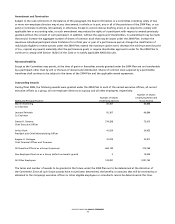

What were the fees incurred by the Company for professional services rendered by KPMG LLP?

The fees incurred by the Company for professional services rendered by KPMG LLP for fiscal 2008 and 2007 were as follows:

2008 2007

Audit Fees $1,229,000 $ 1,510,060

Audit-Related Fees 19,400 105,000

Tax Fees 114,039 521,982

All Other Fees ——

$1,362,439 $ 2,137,042