Bed, Bath and Beyond 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

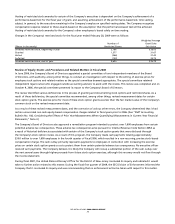

43

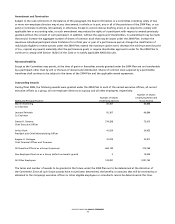

(1) All of these director fees were paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay Directors

Fees in Stock and the number of shares was determined (in accordance with the terms of such plan) based on the fair market value per

share on the second business day following the announcement of the Company’s financial results for its fiscal third quarter, which was

$26.145 per share, the average of the high and low trading prices on January 9, 2009.

(2) Fifty percent of these director fees were paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay

Directors Fees in Stock and the number of shares was determined (in accordance with the terms of such plan) as described in footnote (1).

(3) Represents the value of 1,753 restricted shares of common stock of the Company granted under the Company’s 2004 Incentive

Compensation Plan at fair market value on the date of the Company’s 2008 Annual Meeting of Shareholders (the average of the high and

low trading prices on such date).

Director Independence

The Board of Directors, upon the advice of the Nominating and Corporate Governance Committee, has determined that each of

Mses. Morrison and Stoller and Messrs. Adler, Barshay, Eppler, Gaston, Heller and Kaplan are “independent directors” under the

independence standards set forth in The NASDAQ Listing Rule 5605(a)(2). This determination was based on the fact that each of

these directors is not an executive officer or employee of the Company or any other individual having a relationship which, in the

opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities

of a director. This independence assessment is analyzed annually in both fact and appearance to promote arms-length oversight.

In making its independence determinations, the Board of Directors considered transactions occurring since the beginning of fiscal

2006 between the Company and entities associated with the independent directors or members of their immediate family.

In each case, the Board of Directors determined that, because of the nature of the director’s relationship with the entity and/or

the amount involved, the relationship did not impair the director’s independence. The Board of Director’s independence determi-

nations included reviewing the following relationships; however, in each case, no payments were made to any of the entities

noted, during such entity’slast fiscal year, in excess of 1% of such entity’s consolidated gross revenues, where a director was a

partner or owned morethan a 10% equity interest in, or was an executive officer of, such entity:

•Mr. Adler is a principal or executive officer of several private equity funds, each with broad commercial real estate hold-

ings. During the Company’s 2006 fiscal year, some of such funds had among their investments interests in entities which

held real estate, portions of which were leased to the Company or its subsidiaries, and during the Company’s 2008 fiscal

year, two of the Company’s subsidiaries leased a portion of one property for the operation of stores. The Company also

leases certain store locations from Developers Diversified Realty Corp. (or its affiliates), on whose Board of Directors

Mr.Adler serves.

•Mr.Barshay is an executive officer of Schering-Plough Consumer HealthCare Products, which manufactures a wide

variety of consumer goods (available for sale at many retail outlets), some of which arepurchased by the Company for

resale in the ordinary course of business.

•Mr. Eppler is a (non-equity) pensioned partner of Proskauer Rose LLP, which has received fees for legal services from

the Company during the past three fiscal years and which is continuing to provide legal services to the Company during

fiscal 2009.

•Mr.Gaston is the President of Verizon Foundation, the philanthropic entity of Verizon Communications Inc. The

Company purchases a portion of its telecommunications services from Verizon Communications Inc. on terms and pric-

ing generally available to Verizon customers.

•Mr. Kaplan is a Senior Director of The Goldman Sachs Group, Inc., which receives commissions in connection with the

Company’s stock repurchase program.

•Ms. Morrison was a partner of Riker, Danzig, Scherer, Hyland & Perretti LLP during fiscal 2006, during which time this

firm received fees for legal services from the Company.

Information about Committees of the Board; Compensation Committee Interlocks and Insider Participation

All members of the Audit, Compensation and Nominating and Corporate Governance Committees are considered independent

pursuant to applicable Securities and Exchange Commission (“SEC”) and NASDAQ rules. None of the members of the

Compensation Committee was (i) during the past fiscal year, an officer or employee of the Company or any of its subsidiaries or

(ii) formerly an officer of the Company or any of its subsidiaries. None of our executive officers currently serves, or in the past fis-

cal year has served, as a member of the board of directors or compensation committee of any entity that has one or more execu-

tive officers serving on our Board of Directors or Compensation Committee.