Bed, Bath and Beyond 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND 2008 ANNUAL REPORT

21

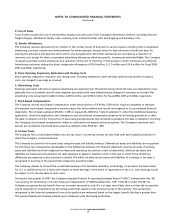

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and liabilities. In

the ordinary course of business, there are transactions and calculations where the ultimate tax outcome is uncertain. Additionally,

the Company’s tax returns are subject to audit by various tax authorities. Although the Company believes that its estimates are

reasonable, actual results could differ from these estimates.

V. Litigation

The Company records an estimated liability related to various claims and legal actions arising in the ordinary course of business

which is based on available information and advice from outside counsel, where appropriate. As additional information becomes

available, the Company reassesses the potential liability related to such claims and legal actions and revises its estimates, as

appropriate. The ultimate resolution of these ongoing matters as a result of future developments could have a material impact

on the Company’s earnings. The Company cannot predict the nature and validity of claims which could be asserted in the future,

and future claims could have a material impact on its earnings.

W. Earnings per Share

The Company presents earnings per share on a basic and diluted basis. Basic earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding. Diluted earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding including the dilutive effect of stock-based awards as

calculated under the treasury stock method.

Stock-based awards of approximately 15.3 million, 10.9 million and 8.6 million shares were excluded from the computation of

diluted earnings per share as the effect would be anti-dilutive for fiscal 2008, 2007 and 2006, respectively.

X. Segments

The Company accounts for its operations as one operating segment.

Y.Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations.” SFAS No. 141R establishes principles and

requirements for how the acquirer in a business combination recognizes and measures in its financial statements the identifiable

assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree at the acquisition date fair value. SFAS No.

141R determines what information to disclose to enable users of the financial statements to evaluate the nature and financial

effects of the business combination. SFAS No. 141R applies prospectively to business combinations for which the acquisition date

is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Early adoption is not

permitted.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities–An Amendment

of FASB Statement 133.” SFAS No. 161 requires enhanced disclosures regarding derivatives and hedging activities, including

enhanced disclosures regarding how: (a) an entity uses derivative instruments; (b) derivative instruments and related hedged

items are accounted for under SFAS No. 133; and (c) derivative instruments and related hedged items affect an entity’s financial

position, financial performance, and cash flows. SFAS No. 161 is effective for fiscal years beginning after November 15, 2008. The

Company does not believe SFAS No. 161 will have a material impact on its consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles.” SFAS 162 identifies the

sources of accounting principles and the framework for selecting the principles used in the presentation of financial statements

that are presented in conformity with Generally Accepted Accounting Principles. SFAS 162 became effective on November 15,

2008. The adoption of SFAS No. 162 did not have a material impact on the Company’s consolidated financial statements.

In December 2008, the FASB issued FSP No. 132(R)-1, “Employers’ Disclosures about Postretirement BenefitPlan Assets.” FSP

No. 132(R)-1 amends SFAS No. 132 (revised 2003), “Employers’ Disclosures about Pensions and Other Postretirement Benefits–an

Amendment of FASB Statements No. 87, 88 and 106” (“SFAS No. 132(R)”). FSP No. 132(R)-1 requires more detailed disclosures

about the assets of a defined benefit pension or other post retirement plan. FSP No. 132(R)-1 is effective for fiscal years

ending after December 15, 2009. The Company does not believe FSP No. 132(R)-1 will have a material impact on its consolidated

financial statements.