Bed, Bath and Beyond 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2008 ANNUAL REPORT

8

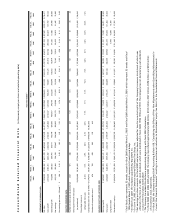

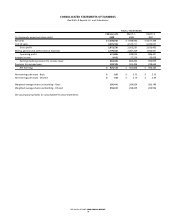

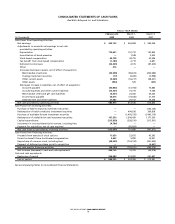

The Company has contractual obligations consisting mainly of operating leases for stores, offices, warehouse facilities and

equipment, purchase obligations and other long-term liabilities which the Company is obligated to pay as of February 28, 2009

as follows:

(in thousands) Total Less than 1 year 1-3 years 4-5 years After 5 years

Operating Lease Obligations (1) $3,162,758 $ 424,635 $ 794,043 $ 642,554 $ 1,301,526

Purchase Obligations (2) 418,697 418,697 — — —

Other long-term liabilities (3) 315,421 — — — —

Total Contractual Obligations $ 3,896,876 $ 843,332 $ 794,043 $ 642,554 $ 1,301,526

(1) The amounts presented represent the future minimum lease payments under non-cancelable operating leases. In addition to minimum rent,

certain of the Company’s leases require the payment of additional costs for insurance, maintenance and other costs. These additional

amounts are not included in the table of contractual commitments as the timing and/or amounts of such payments are not known. As of

February 28, 2009, the Company has leased sites for 41 new stores planned for opening in fiscal 2009 or 2010, for which aggregate minimum

rental payments over the term of the leases are approximately $229.9 million and are included in the table above.

(2) Purchase obligations primarily consist of purchase orders for merchandise and capital expenditures.

(3) Amounts recorded as deferred rent and other liabilities and income taxes payable in the Consolidated Balance Sheet as of February28, 2009

have been reflected only in the Total column in the table above as the timing and/or amount of any cash payment is uncertain. Deferred rent

and other liabilities are primarily comprised of deferred rent, workers’ compensation and general liability reserves and various other accruals.

SEASONALITY

The Company exhibits less seasonality than many other retail businesses, although sales levels are generally higher in August,

November and December,and generally lower in Februaryand October.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past year. There can

be no assurance, however, that the Company’s operating results will not be affected by inflation in the future.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 2006, the FASB issued FIN 48. FIN 48 addresses the determination of whether tax benefits claimed or expected to be

claimed on a tax return should be recorded in the financial statements. Under FIN 48, a company may recognize the tax benefit

from uncertain tax positions only if it is at least more likely than not that the tax position will be sustained on examination by

the taxing authorities based on the technical merits of the position. The tax benefits recognized in the financial statements from

such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized

upon settlement with the taxing authorities. FIN 48 also provided guidance on derecognition, classification, interest and penalties

on income taxes, accounting in interim periods and requires increased disclosures.

On March 4, 2007, the Company adopted FIN 48 and recognized a $13.1 million increase to retained earnings to reflect the

change to its liability for gross unrecognized tax benefits as required. The Company also recorded additional gross unrecognized

tax benefits, and corresponding higher deferred tax assets, of $35.6 million as a result of the adoption.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.”

SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and

expands disclosures about fair value measurements. SFAS No. 157 applies under other accounting pronouncements that require

or permit fair value measurements and accordingly, does not require any new fair value measurements. SFAS No. 157 was effec-

tive for fiscal years beginning after November 15, 2007. In February 2008, the FASB issued FASB Staff Position (“FSP”) No. 157-2,

aone-year deferral of SFAS No. 157’sfair value measurement requirements for non-financial assets and liabilities that are not

required or permitted to be measured at fair value on a recurring basis. In October 2008, the FASB also issued FSP No. 157-3,

“Determining the Fair Value of a Financial Asset When the Market for That Asset is Not Active.” This FSP clarifies the application

of SFAS No. 157 in a market that is not active and provides an example to illustrate key considerations in determining the fair

value of a financial asset when the market for that asset is not active. FSP No. 157-3 was effective upon issuance. On March 2,

2008, the Company adopted SFAS No. 157 and subsequently adopted FSP No. 157-3. The adoption of SFAS No. 157 and FSP

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)