Bed, Bath and Beyond 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND 2008 ANNUAL REPORT

31

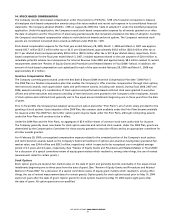

14. STOCK-BASED COMPENSATION

The Company records stock-based compensation under the provisions of SFAS No. 123R which requires companies to measure

all employee stock-based compensation awards using a fair value method and record such expense in its consolidated financial

statements. The Company adopted SFAS No. 123R on August 28, 2005 (the “date of adoption”) under the modified prospective

application. Under this application, the Company records stock-based compensation expense for all awards granted on or after

the date of adoption and for the portion of previously granted awards that remained unvested at the date of adoption. Currently,

the Company’s stock-based compensation relates to restricted stock awards and stock options. The Company’s restricted stock

awards are considered nonvested share awards as defined under SFAS No. 123R.

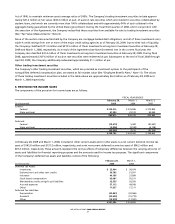

Stock-based compensation expense for the fiscal year ended February 28, 2009, March 1, 2008 and March 3, 2007 was approxi-

mately $43.7 million ($27.2 million after tax or $0.11 per diluted share), approximately $43.8 million ($28.4 million after tax or

$0.11 per diluted share) and approximately $82.6 million ($52.6 million after tax or $0.18 per diluted share), respectively. Stock-

based compensation for the fiscal year ended March 3, 2007, included expenses related to the cash payment of $30.0 million to

remediate potential adverse tax consequences for Internal Revenue Code 409A and approximately $8.2 million related to revised

measurement dates (see “Review of Equity Grants and Procedures and Related Matters in Fiscal 2006” below). In addition, the

amount of stock-based compensation cost capitalized for each of the years ended February 28, 2009 and March 1, 2008 was

approximately $1.2 million.

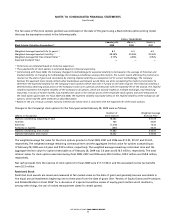

Incentive Compensation Plans

The Company currently grants awards under the Bed Bath & Beyond 2004 Incentive Compensation Plan (the “2004 Plan”).

The 2004 Plan is a flexible compensation plan that enables the Company to offer incentive compensation through stock options,

restricted stock awards, stock appreciation rights and performance awards, including cash awards. During fiscal 2008, 2007 and

2006, awards consisting of a combination of stock options and performance-based restricted stock were granted to executive

officers and other executives and awards consisting of restricted stock were granted to the Company’s other employees. Awards

of stock options and restricted stock generally vest in five equal annual installments beginning one to three years from the date

of grant.

Prior to fiscal 2004, the Company had adopted various stock option plans (the “Prior Plans”), all of which solely provided for the

granting of stock options. Upon adoption of the 2004 Plan, the common stock available under the Prior Plans became available

for issuance under the 2004 Plan. No further option grants may be made under the Prior Plans, although outstanding awards

under the Prior Plans will continue to be in effect.

Under the 2004 Plan and the Prior Plans, an aggregate of 83.4 million shares of common stock wereauthorized for issuance.

The Company generally issues new shares for stock option exercises and restricted stock awards. Under the 2004 Plan, grants are

determined by the Compensation Committee for those awards granted to executive officers and by an appropriate committee for

all other awards granted.

As of February 28, 2009, unrecognized compensation expense related to the unvested portion of the Company’s stock options

and restricted stock awards, based on the Company’s historical treatment of options and awards as having been granted at fair

market value, was $34.4 million and $89.3 million, respectively, which is expected to be recognized over a weighted average

period of 2.3 years and 4.4 years, respectively.(See “Review of Equity Grants and Procedures and Related Matters in Fiscal 2006”

for a discussion of a special committee review of equity grant matters which resulted in, among other things, the use of revised

measurement dates for certain grants.)

Stock Options

Stock option grants are issued at fair market value on the date of grant and generally become exercisable in five equal annual

installments beginning one to three years from the date of grant. (See “Review of Equity Grants and Procedures and Related

Matters in Fiscal 2006” for a discussion of a special committee review of equity grant matters which resulted in, among other

things, the use of revised measurement dates for certain grants). Option grants for stock options issued prior to May 10, 2004

expire ten years after the date of grant. Option grants for stock options issued since May 10, 2004 expire eight years after

the date of grant. All option grants are non-qualified.