Bed, Bath and Beyond 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2008 ANNUAL REPORT

30

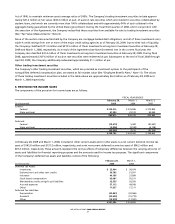

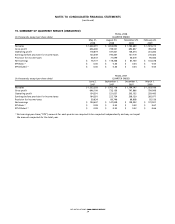

11. EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company has two defined contribution savings plans covering all eligible employees of the Company (“the Plans”). During

fiscal 2006, a 401(k) savings plan, which was frozen effective December 31, 2003, was merged into one of the Plans. Participants of

the Plans may defer annual pre-tax compensation subject to statutory and Plan limitations. Effective January 1, 2006, a certain

percentage of an employee’s contributions, will be matched by the Company, subject to certain statutory and Plan limitations. This

match will vest over a specified period of time. The Company’s match was approximately $6.9 million, $5.9 million and $4.8 million

for fiscal 2008, 2007 and 2006, respectively, which was expensed as incurred.

Nonqualified Deferred Compensation Plan

The Company has a nonqualified deferred compensation plan (“NQDC”) for the benefit of employees defined by the Internal

Revenue Service as highly compensated. A certain percentage of an employee’s contributions may be matched by the Company,

subject to certain Plan limitations. This match will vest over a specified period of time. The Company’s match was approximately

$0.4 million, $0.7 million and $0.4 million for fiscal 2008, 2007 and 2006, respectively, which was expensed as incurred.

Changes in the fair value of the trading securities related to the NQDC and the corresponding change in the associated liability

are included within interest income and selling, general and administrative expenses respectively, in the Consolidated Statements

of Earnings. Historically, these changes have resulted in no impact to the Consolidated Statements of Earnings.

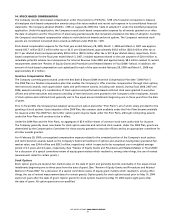

Defined Benefit Plan

The Company has a non-contributory defined benefit pension plan for the CTS employees, hired on or before July 31, 2003, who

meet specified age and length-of-service requirements. The benefits are based on years of service and the employee’s compensa-

tion near retirement. In fiscal 2006, the Company adopted SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans–an Amendment of FASB Statements No. 87, 88, 106 and 132(R),” (“SFAS No. 158”) on a prospective

basis. SFAS No. 158 requires an employer to recognize the overfunded or underfunded status of a defined benefit postretirement

plan as an asset or liability in its statement of financial position and recognize changes in the funded status in the year in which

the changes occur. In addition, SFAS No. 158 requires companies to measure plan assets and benefit obligations utilizing a fiscal

year end measurement date. In fiscal 2008, subsequent to the initial adoption as permitted under SFAS No. 158, the Company

adopted the fiscal year end measurement date and recorded an immaterial adjustment to retained earnings; prior to fiscal 2008,

the Company utilized a December 31 measurement date. For the years ended February28, 2009 and March 1, 2008, the net

periodic pension cost was not material to the Company’s results of operations. The Company has a $7.2 million and $0.7 million

liability, which is included in deferred rent and other liabilities as of February 28, 2009 and March 1, 2008, respectively. In addition,

as of February 28, 2009 and March 1, 2008, the Company recognized a loss of $0.9 million, net of taxes of $0.5 million, and

income of $3.6 million, net of taxes of $2.2 million, respectively, within accumulated other comprehensive loss.

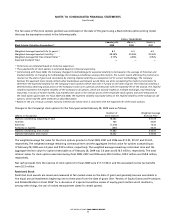

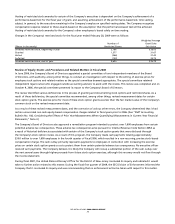

12. COMMITMENTS AND CONTINGENCIES

The Company maintains employment agreements with its Co-Chairmen, which extend through June 2010. The agreements

provide for a base salary(which may be increased by the Boardof Directors), termination payments, post-retirement benefits and

other terms and conditions of employment. In addition, the Company maintains employment agreements with other executives

which provide for severance pay and, in some instances, certain other supplemental retirement benefits.

The Company is involved in various claims and legal actions arising in the ordinary course of business. In the opinion of

management, the ultimate disposition of these matters will not have a material adverse effect on the Company’s consolidated

financial position, results of operations or liquidity.

13. SUPPLEMENTAL CASH FLOW INFORMATION

The Company paid income taxes of $261.3 million, $359.9 million and $388.4 million in fiscal 2008, 2007 and 2006, respectively.

The Company recorded an accrual for capital expenditures of $21.6 million, $36.6 million and $53.9 million as of February 28,

2009, March 1, 2008 and March 3, 2007, respectively.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)