Bed, Bath and Beyond 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2008 ANNUAL REPORT

24

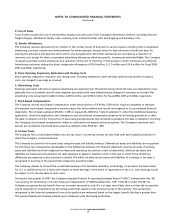

5. LINES OF CREDIT

At February 28, 2009, the Company maintained two uncommitted lines of credit of $100 million each, with expiration dates of

September 3, 2009 and February 26, 2010, respectively. These uncommitted lines of credit are currently and are expected to be

used for letters of credit in the ordinary course of business. In addition, under these uncommitted lines of credit, the Company

can obtain unsecured standby letters of credit. During fiscal 2008, the Company did not have any direct borrowings under the

uncommitted lines of credit. As of February 28, 2009, there was approximately $7.1 million of outstanding letters of credit and

approximately $45.5 million of outstanding unsecured standby letters of credit, primarily for certain insurance programs.

Although no assurances can be provided, the Company intends to renew both uncommitted lines of credit before the respective

expiration dates.

At March 1, 2008, the Company maintained two uncommitted lines of credit of $100 million each. These uncommitted lines of

credit were utilized for letters of credit in the ordinary course of business. During fiscal 2007, the Company did not have any direct

borrowings under the uncommitted lines of credit. As of March 1, 2008, there was approximately $8.1 million of outstanding

letters of credit and approximately $49.8 million of outstanding unsecured standby letters of credit, primarily for certain insurance

programs.

6. FAIR VALUE MEASUREMENTS

On March 2, 2008, the Company adopted SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities-

Including an amendment of FASB Statement No. 115.” SFAS No. 159 permits companies to choose to measure certain financial

assets and liabilities at fair value (the “fair value option”). If the fair value option is elected, any upfront costs and fees related to

the item must be recognized in earnings and cannot be deferred, e.g. debt issue costs. The fair value election is irrevocable and

may generally be made on an instrument-by-instrument basis, even if a company has similar instruments that it elects not to fair

value. At the adoption date, unrealized gains and losses on existing items for which fair value has been elected are reported as

acumulative adjustment to beginning retained earnings. The Company chose not to elect the fair value option for its financial

assets and liabilities existing on March 2, 2008, and did not elect the fair value option for any financial assets and liabilities trans-

acted during fiscal 2008, except for a put option related to the Company’s auction rate securities that was recorded in conjunction

with a settlement agreement with one if its investment firms, as more fully described below.

On March 2, 2008, the Company also adopted SFAS No. 157, “Fair Value Measurements,” as required for financial assets and

liabilities. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting

principles and expands disclosures about fair value measurements. In February 2008, the FASB issued FASB Staff Position (“FSP”)

No. 157-2, a one-year deferral of SFAS No. 157’s fair value measurement requirements for non-financial assets and liabilities that

arenot required or permitted to be measured at fair value on a recurring basis. In October 2008, the FASB issued FSP No. 157-3,

“Determining the Fair Value of a Financial Asset When the Market for That Asset is Not Active.” This FSP clarifies the application

of SFAS No. 157 in a market that is not active and provides an example to illustrate key considerations in determining the fair

value of a financial asset when the market for that asset is not active. FSP No. 157-3 was effective upon issuance. The adoption

of SFAS No. 157 and FSP No. 157-3 for the Company’s financial assets and liabilities did not have a material impact on its consoli-

dated financial statements. The Company does not expect the adoption of SFAS No. 157 as it pertains to non-financial assets and

liabilities to have a material impact on its consolidated financial statements.

Under SFAS No. 157, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e.

“the exit price”) in an orderly transaction between market participants at the measurement date. In determining fair value, the

Company uses various valuation approaches, including quoted market prices and discounted cash flows. SFAS No. 157 also

establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use

of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that

market participants would use in pricing the asset or liability developed based on market data obtained from independent

sources. Unobservable inputs areinputs that reflect a company’s judgment concerning the assumptions that market participants

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)