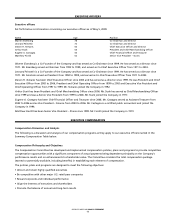

Bed, Bath and Beyond 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

60

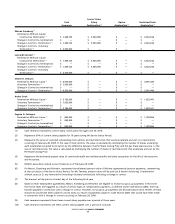

Unlike prior years in which stock option awards were made by the Committee based on the number of shares covered by the

options, and based upon advice from JFR, the stock option awards for fiscal 2008 were made in dollars (with the number of shares

covered by the options determined by dividing the dollar amount of the grant by the Stock Option Fair Value). The Committee

believes that making stock option awards in dollar amounts rather than share amounts is an increasingly prevalent practice and is

advisable because making stock option awards in dollar amounts allows the Compensation Committee to align stock option

awards with the value of the option grants. Making stock option awards in dollars also enables the Compensation Committee to

more readily evaluate appropriate aggregate compensation amounts and percentage increases or decreases for executives, in

comparison to making stock option awards in share amounts (the value of which varies depending on the trading price of the

Company’s stock and other factors).

While not increasing the aggregate dollar amount of equity compensation for the named executive officers in fiscal 2009, the

Company allocated 50% of equity compensation awards to Mr. Temares in restricted stock in 2009 compared to approximately

34% in restricted stock in 2008. The Committee made this reallocation to provide for equal allocation between restricted stock

awards based on specifically-identified performance criteria and stock option awards that are tied to stock price performance.

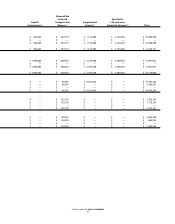

In the view of the Compensation Committee, the base salary, stock option grants, and restricted stock awards constituted

compensation packages for the Chief Executive Officer and for the Co-Chairmen appropriate for a company with the revenues

and earnings of the Company. The stock options granted to the Chief Executive Officer vest in five equal annual installments,

while the stock options awarded to the Co-Chairmen vest in three equal annual installments, in each case commencing on the first

anniversary of the grant date and based on continued service to the Company. The restricted stock awards to each such executive

are conditioned on the performance-based test described above with time vesting in five equal annual installments, in each case

commencing on the first anniversary of the grant date and based on continued service to the Company.

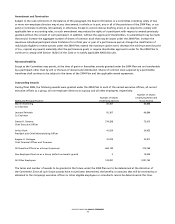

Base salaries and the dollar value of equity awards for fiscal 2009 will remain unchanged from fiscal 2008. The base salaries of

Mr. Stark in fiscal 2007 and 2008 were $950,000 and $1,055,000, respectively. The base salaries of Mr. Castagna in fiscal 2007 and

2008 were $755,000 and $840,000, respectively.

In fiscal 2007, Mr. Stark and Mr. Castagna both received option awards in the amount of 25,000 shares, vesting in five equal annu-

al installments commencing on the thirdanniversary of the grant date, based on continued service to the Company. In fiscal 2008

(when option grants weremade in dollars as described above), Mr.Stark and Mr.Castagna both received option awards based on

adollar value of $590,000 (which translated to 41,029 option shares), with the same vesting schedule as the fiscal 2007 option

awards. Mr. Stark was awarded shares of restricted stock in each of fiscal 2007 and 2008 having a market value on the date of

grant of $1,000,000. Mr. Castagna was awarded shares of restricted stock in each of fiscal 2007 and 2008 having a market value on

the date of grant of $750,000. The restricted stock awards to both Mr. Stark and Mr. Castagna for both fiscal 2007 and 2008 were

conditioned on the performance-based test described above with time vesting in five equal annual installments commencing on

the thirdanniversaryof the grant date.

For further discussion related to equity grants to the named executive officers, see “Potential Payments Upon Termination or

Change in Control” below.

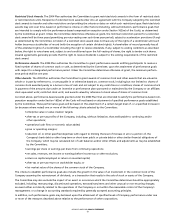

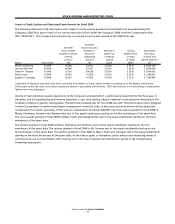

Other Benefits

The Company provides the named executive officers with the same benefits offered to all other employees. The cost of these

benefits constitutes a small percentage of each named executive officer’s total compensation. Key benefits include paid vacation,

premiums paid for long-termdisability insurance, a matching contribution to the named executive officer’s 401(k) plan account,

and the payment of a portion of the named executive officer’s premiums for healthcare and basic life insurance.

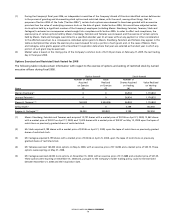

In addition, effective January1, 2006, the Company adopted a nonqualified deferred compensation plan for the benefit of certain

highly compensated employees, including the named executive officers. The plan provides that a certain percentage of an

employee’s contributions may be matched by the Company, subject to certain limitations. This matching contribution will vest over

aspecified period of time. See “Deferred Compensation” below.

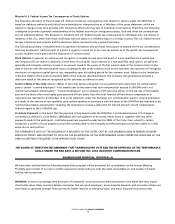

Mr.Temares, as Chief Executive Officer, has a supplemental retirement benefit agreement with the Company under which if he

remains employed by the Company through June 12, 2012 (or the earlier occurrence of a change of control of the Company), he is

entitled to receive a supplemental retirement benefit upon his separation from service from the Company, for ten years, in an

amount equal to fifty percent of his annual salary at the date of termination of employment.