Bed, Bath and Beyond 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

61

The Company also provides the named executive officers with certain perquisites including tax preparation services and car

service, in the case of Messrs. Eisenberg and Feinstein, and a car allowance, in the case of all named executive officers. The

Compensation Committee believes all such perquisites are reasonable and consistent with its overall objective of attracting and

retaining our named executive officers.

The Company reviews these other benefits and perquisites on an annual basis and makes adjustments as warranted based on

competitive practices and the Company’s performance.

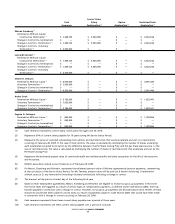

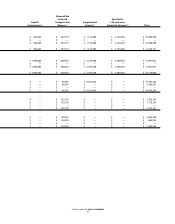

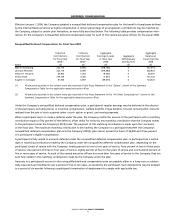

See the “All Other Compensation” column in the Summary Compensation Table for further information regarding these benefits

and perquisites, and “Potential Payments Upon Termination or Change in Control” below for information regarding termination

and change in control payments and benefits.

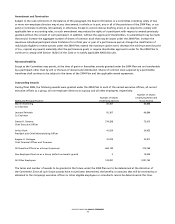

Impact of Accounting and Tax Considerations

The Compensation Committee considers the accounting cost associated with equity compensation and the impact of Section

162(m) of the Code, which generally prohibits any publicly-held corporation from taking a federal income tax deduction for

compensation paid in excess of $1 million in any taxable year to the named executive officers, subject to certain exceptions for

performance-based compensation. Stock options and performance-based compensation granted to our named executive officers

are intended to satisfy the performance-based exception and be deductible. Base salary amounts in excess of $1 million are not

deductible by the Company.

Policy on the Recovery of Incentive Compensation

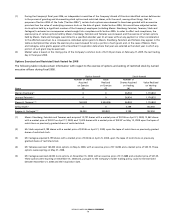

In April 2009, the Boardadopted a policy as part of the Company’s corporate governance guidelines on the recovery of incentive

compensation, commonly referred to as a “clawback policy,” applicable to the Company’s named executive officers (as defined

under Item 402(a)(3) of Regulation S-K).

Advisory Vote on Executive Compensation

The Company anticipates that non-binding advisory votes on compensation practices, commonly referred to as “say-on-pay,”

may in the futurebe mandated by law,in which case the Company will comply with such requirements.

In any event, if no such advisoryvote is required by law at the time of the Company’s 2011 Annual Meeting, the Board has

approved in principle that, effective with the Company’s 2011 Annual Meeting, the Company will implement a non-binding,

advisory vote by the Company’s shareholders on the Compensation Committee’s compensation philosophy, policies and procedures

for the Company’s named executive officers.

Conclusion

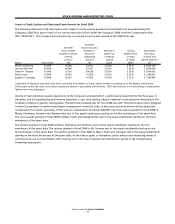

After careful review and analysis, the Company believes that each element of compensation and the total compensation provided

to each of its named executive officers is reasonable and appropriate. The value of the compensation payable to the named exec-

utive officers is significantly tied to the Company’sperformance and the return to its shareholders. The Company believes that its

compensation programs will allow it to attract and retain a top performing management team.