Bed, Bath and Beyond 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2008 ANNUAL REPORT

28

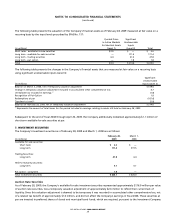

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not

that it is realizable through a combination of future taxable income, the deductibility of future net deferred tax liabilities and tax

planning strategies.

The Company adopted FIN 48 on March 4, 2007 (“FIN 48 Adoption Date”). FIN 48 addresses the determination of whether tax

benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FIN 48, the

Company may recognize the tax benefit from uncertain tax positions only if it is at least more likely than not that the tax position

will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recog-

nized in the financial statements from such a position should be measured based on the largest benefit that has a greater than

fifty percent likelihood of being realized upon settlement with the taxing authorities. FIN 48 also provided guidance on derecog-

nition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures.

Upon adoption of FIN 48, the Company recognized a $13.1 million increase to retained earnings to reflect the change to its

liability for gross unrecognized tax benefits as required. The Company also recorded additional gross unrecognized tax benefits,

and corresponding higher deferred tax assets, of $35.6 million as a result of the adoption. At March 4, 2007 the total amount of

gross unrecognized tax benefits was $163.3 million, of which $119.9 million would impact the Company’s effective tax rate. The

Company recognizes accrued interest and penalties related to gross unrecognized tax benefits in the provision for income taxes.

As of March 4, 2007, the liability for gross unrecognized tax benefits included approximately $27.5 million of accrued interest.

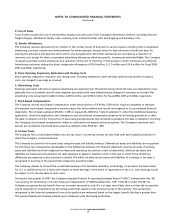

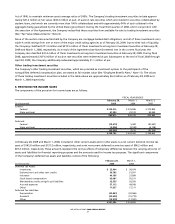

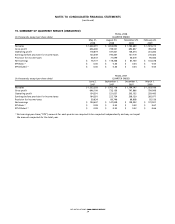

The following table summarizes the activity related to the gross unrecognized tax benefits from uncertain tax positions:

February 28, March 1,

(in thousands) 2009 2008

Balance at beginning of year $83,139)$163,297)

Increase related to current year positions 13,790)16,920)

Increase related to prior year positions 8,962)36,584)

Decrease related to prior year positions (5,249) (81,330)

Settlements (2,843) (44,175)

Lapse of statute of limitations (1,102) (2,617)

Other —)(5,540)

Balance at end of year $96,697)$ 83,139)

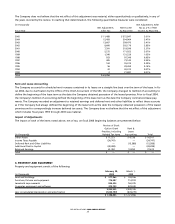

At February 28, 2009, the Company has recorded approximately $8.5 million and $88.2 million of gross unrecognized tax benefits

in current and non-current taxes payable, respectively, on the consolidated balance sheet of which approximately $89.3 million

would impact the Company’s effective tax rate. At March 1, 2008, the Company had recorded approximately $7.7 million and

$75.4 million of gross unrecognized tax benefits in current and non-current taxes payable, respectively, on the consolidated

balance sheet of which approximately $76.0 million would have impacted the Company’s effective tax rate. As of February 28,

2009 and March 1, 2008, the liability for gross unrecognized tax benefits included approximately $18.2 million and $14.3 million,

respectively, of accrued interest. The Company recorded an increase of interest of approximately $4.6 million for the year

ended February 28, 2009 and a decrease of interest of approximately of $1.9 million for the year ended March 1, 2008, for

gross unrecognized tax benefits in the consolidated statement of earnings.

The Company anticipates that any adjustments to gross unrecognized tax benefits which will impact income tax expense, due

to the settlement of audits and the expiration of statutes of limitations, will not exceed $0.9 million in the next twelve months.

However, actual results could differ from those currently anticipated.

As of February 28, 2009, the Company operated in 49 states, the District of Columbia, Puerto Rico and Canada and files income

tax returns in the United States and various state, local and international jurisdictions. The Company is currently under examina-

tion by the Internal Revenue Service for tax years 2001 through 2005. The Company is also open to examination for state and

local jurisdictions with varying statutes of limitations, generally ranging from three to five years.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)