Bed, Bath and Beyond 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

58

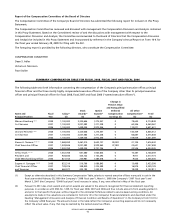

The compensation approved by the Compensation Committee for each of Messrs. Eisenberg, Feinstein and Temares for fiscal 2008

and 2009 was in the amounts and comprised of the elements recommended by JFR. The compensation approved by the

Compensation Committee for the other named executive officers for fiscal 2008 and 2009 was determined by the Compensation

Committee, taking into account the recommendations of the Co-Chairmen and Chief Executive Officer and certain data the

Compensation Committee requested from JFR.

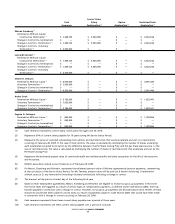

Elements of Compensation

The Company seeks to provide total compensation packages to our employees, including our named executive officers, that

implement our compensation philosophy. The components of our compensation programs are base salary, equity compensation

(consisting of stock options and restricted stock awards), retirement and other benefits (consisting of health plans, a limited 401(k)

plan match and a deferred compensation plan) and perquisites. The Company believes that its executive cash compensation is low

compared to the other companies in our peer group. In fact, according to the analysis prepared by JFR, the aggregate total cash

compensation of Messrs. Eisenberg, Feinstein and Temares in fiscal 2008 was in the 13th percentile of Peer Group 1 cash compen-

sation for the top three executives. The Company places greater emphasis in the compensation packages for named executive

officers on equity incentive compensation in order to align compensation more closely with performance results and the creation

of shareholder value. The Company does not have a cash bonus program for executive officers.

Base Salary

The Company pays base salaries to provide our named executive officers with current, regular compensation that is appropriate

for their position, experience and responsibilities. As noted above, the Company believes that cash compensation levels for our

named executive officers are lower than our peers as the Company places greater emphasis on equity compensation.

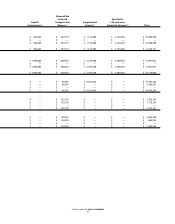

Equity Compensation

The Company’s overall approach to equity compensation is to make equity awards comprised of a combination of stock options

and restricted stock to all executive officers, including the named executive officers, and a small number of other executives.

Commencing in fiscal 2007, these grants are made on May 10 of each year (or the following trading day should such date fall on

aweekend or holiday). The vesting provisions relating to equity compensation have been and continue to be determined with

the principal purpose of retaining the Company’sexecutives and key employees. The Company believes its equity compensation

policies have been highly successful in the long term retention of its executives and key employees, including its named executive

officers.

Consistent with the Company’shistoric practice, the stock options vest over time, subject, in general, to the named executive

officers remaining in the Company’s employ on specified vesting dates. Vesting of the restricted stock awarded to these named

executive officers is dependent on (i) the Company’s achievement of a performance-based test for the fiscal year in which the

grant is made, and (ii) assuming achievement of the performance-based test, time vesting, subject, in general, to the executive

remaining in the Company’s employ on the specified vesting dates.

The performance-based test requires that the Company’s net income in the fiscal year exceed the Company’s net income in the

prior fiscal year or that the Company’s net income as a percentage of sales place it in the top half of the companies in the S&P 500

Retailing Index with respect to such measurement. Net income is adjusted for such purpose to reflect (i) mergers, acquisitions,

consolidations or dispositions, (ii) changes in accounting methods, and (iii) extraordinary items, as defined in APB 30, or stock

repurchase or dividend activity.The Company believes that this performance-based test meets the standard for performance-based

compensation under the Code so that the restricted stock awards will be deductible compensation for certain executives if their

annual compensation exceeds $1 million.

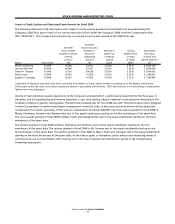

For fiscal 2007 and for fiscal 2008, the performance-based test was satisfied in that the Company’s net income as a percentage of

sales for the prior fiscal year placed it in the top half of the S&P 500 Retailing Index for fiscal 2007 and top quartile for fiscal 2008.

The S&P 500 Retailing Index included the following companies in fiscal 2007: Abercrombie & Fitch, Amazon.com, AutoNation,

AutoZone, Best Buy, Big Lots, Circuit City, Dillard’s, Expedia, Family Dollar, Gamestop, Gap, Genuine Parts, Home Depot, IAC