Bed, Bath and Beyond 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND 2008 ANNUAL REPORT

25

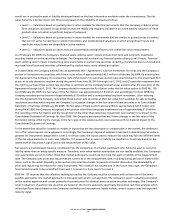

would use in pricing the asset or liability developed based on the best information available under the circumstances. The fair

value hierarchy is broken down into three levels based on the reliability of inputs as follows:

•Level 1 — Valuations based on quoted prices in active markets for identical instruments that the Company is able to access.

Since valuations are based on quoted prices that are readily and regularly available in an active market, valuation of these

products does not entail a significant degree of judgment.

•Level 2 — Valuations based on quoted prices in active markets for instruments that are similar, or quoted prices in markets

that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

•Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

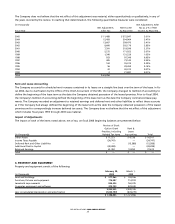

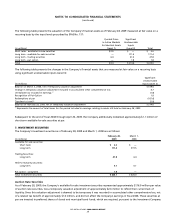

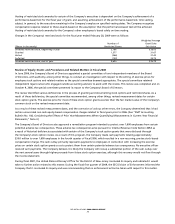

As of February 28, 2009, the Company’s financial assets utilizing Level 1 inputs include short term and long term investment

securities traded on active securities exchanges. The Company did not have any financial assets utilizing Level 2 inputs. Financial

assets utilizing Level 3 inputs included long term investments in auction rate securities consisting of preferred shares of closed end

municipal bond funds and securities collateralized by student loans, and a related put option.

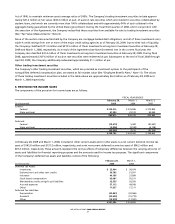

In October 2008, the Company entered into an agreement (the “Agreement”) with the investment firm that sold the Company a

portion of its auction rate securities, which have a par value of approximately $43.2 million at February 28, 2009. By entering into

the Agreement, the Company (1) received the right (“Put Option”) to sell these auction rate securities back to the investment firm

at par, at its sole discretion, anytime during the period from June 30, 2010 through July 2, 2012, and (2) gave the investment firm

the right to purchase these auction rate securities or sell them on the Company’s behalf at par anytime after the execution of the

Agreement through July 2, 2012. The Company elected to measure the Put Option under the fair value option of SFAS No. 159.

As of February 28, 2009, the fair value of the Put Option was approximately $1.8 million, and accordingly, for fiscal 2008, the

Company recorded pre-tax income of approximately $1.8 million and a corresponding long term investment. Upon entering

into the Agreement, the Company reclassified these auction rate securities at their fair value from available-for-sale to trading

investment securities which requires the Company to recognize changes in the fair value of these securities in its Consolidated

Statement of Earnings. At February 28, 2009, the fair value of these auction rate securities is approximately $41.4 million and

during fiscal 2008, the Company recognized a net pre-tax other-than-temporary impairment loss of approximately $1.8 million.

The recording of the Put Option and the recognition of the other-than-temporary impairment loss resulted in no impact to the

Consolidated Statement of Earnings for fiscal 2008. The Company anticipates that any future changes in the fair value of the

Put Option will be offset by the changes in the fair value of the related auction rate securities with no material impact to the

Consolidated Statement of Earnings.

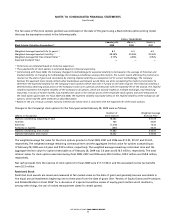

Tothe extent that valuation is based on models or inputs that areless observable or unobservable in the market, the determina-

tion of fair value requires more judgment. Accordingly, the Company’s degree of judgment exercised in determining fair value is

greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels

of the fair value hierarchy. In such cases, SFAS No. 157 requires that an asset or liability be classified in its entirety based on the

lowest level of input that is significant to the measurement of fair value.

Fair value is a market-based measure considered from the perspective of a market participant who holds the asset or owes the

liability rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Company’s

own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement

date. The Company uses prices and inputs that are current as of the measurement date, including during periods of market dislo-

cation, such as the recent illiquidity in the auction rate securities market. In periods of market dislocation, the observability of

prices and inputs may be reduced for many instruments. This condition has caused, and in the future may cause, the Company’s

financial instruments to be reclassified from Level 1 to Level 2 or from Level 2 to Level 3.

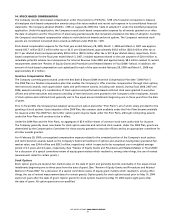

SFAS No. 157 requires that the valuation techniques used by the Company must be consistent with at least one of the three

possible approaches: the market approach, income approach and/or cost approach. The Company’s Level 1 valuations are based

on the market approach and consist primarily of quoted prices for identical items on active securities exchanges. The Company’s

Level 3 valuations of auction rate securities arebased on the income approach, specifically,discounted cash flow analyses which

utilize significant inputs based on the Company’s estimates and assumptions. Inputs include current coupon rates and expected

maturity dates.