BP 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Safety Before addressing our financial performance, let me

talk about the things that did not go so well, for these have

absorbed much of my and the team’s attention. Safety has

always been one of our core priorities. Scrutiny of the group

has inevitably been dominated by the investigations into the

March 2005 explosion at the Texas City refinery, in which 15

of our co-workers tragically lost their lives, and into the pipeline

corrosion at Prudhoe Bay in Alaska.

It is an unavoidable fact that we operate in a hazardous

industry. But accidents of any kind cause people to question

the values that underpin our company. They also cast a shadow

over our many successes – and the fact that, around the world,

hundreds of thousands of employees and contractors work

safely for BP, with dedication and integrity.

BP aspires to be an industry leader in the three dimensions

of safety – personal safety, process safety and the

environment. We have had a strong track record in the day-

to-day personal safety of our people. In 2006, our recordable

injury frequency rate, the standard industry measure, fell to

0.47 per 200,000 hours worked, the lowest in our history.

There were also seven fatalities. Every death is a tragedy, but

we should recognize that this number has reduced significantly,

to the lowest level in nearly 20 years of reporting. I am

particularly pleased with the large drop in driving-related

fatalities, from 14 in 2003 to two in 2006, following the

implementation of our new driving safety standard. On

the environment, we continue to make progress in reducing

greenhouse gas emissions and the environmental impact

of our products.

Our response to the Baker report In January, former US

Secretary of State James A Baker, III and his panel published

a candid and thorough report into process safety management

at our US refineries. The panel was established by BP on

the recommendation of the US Chemical Safety and Hazard

Investigation Board in the wake of the Texas City tragedy and

was intended to provide lessons not just for us but for the

entire industry.

BP will implement the Baker panel’s recommendations and

we are now consulting with the panel on how best to do that.

Many of the recommendations are consistent with our own

internal reviews and our aim now is to develop a timely and

intelligent plan of action in order to transform BP into an

industry leader in process safety management.

Importantly, the panel did not conclude that BP intentionally

withheld resources on any safety-related assets or projects

for budgetary or cost reasons. The panel interviewed hundreds

of employees in the course of its work and observed that it

had seen no information to suggest that anyone – from BP’s

board members to its hourly-paid workers – acted in anything

other than good faith.

Our response to the Baker report comes alongside what

we were already doing to embed consistently high standards

of safety and operational integrity throughout BP. This includes

an ambitious four-year programme of investment in safety

and operational integrity right across the group and the

creation of an advisory board of external experts to assist

and advise BP America Inc. in monitoring the operations of

the US businesses, with particular focus on compliance, safety

and regulatory affairs. At Texas City itself, a new leadership

team has introduced world-class training programmes,

increased the number of safety inspectors, renovated major

units and relocated hundreds of employees. We expect Texas

City to be processing about 400,000 barrels per day of crude

oil by the end of 2007.

We are also implementing lessons from the two oil spills

and the cases of corrosion that occurred at Prudhoe Bay in

2006. When corrosion was found in August, we rapidly shut

down production as a precaution. Nearly 27,000 individual

radiographic or ultrasonic inspections of the pipeline system

have since been carried out and output was restored to its

full level in late 2006. We are replacing 16 miles of transit

lines, increasing spending on major maintenance and retaining

a team of independent corrosion experts as advisers.

We took similar precautionary action to replace subsea

components for the Thunder Horse platform in the Gulf

of Mexico. The components had passed industry tests and

met regulatory requirements but a metallurgical failure was

revealed when our engineers tested compliance with BP’s

own, more stringent, standards. We are now replacing the

equipment in question and expect Thunder Horse to start

production by the end of 2008.

Integrity We are also taking action to ensure that people

across BP behave with consistent integrity. During the year,

there were allegations of market manipulation in our US trading

operations. We have responded to these serious allegations

by making internal improvements and instituting a thorough

internal review by independent auditors.

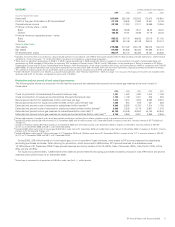

Performance In terms of financial performance, the year

was a record one, with replacement cost profit rising 15%

to $22.3 billion, representing a return on average capital

employed of 22%. Thanks to our share buyback programme,

earnings per share rose faster than profits, by 22%, to

111.1 cents per share.

Our role as a leading international oil company is to build

strong and sustainable supply chains between producing

countries and markets around the world. In emerging economies

such as Algeria, Angola, Azerbaijan, Egypt, Indonesia and

Trinidad & Tobago, our investments help to increase the flow

of supplies to world markets as well as strengthening local

economies and contributing to economic development.

Our joint venture in Russia, TNK-BP, brings together BP’s

experience with local assets, capabilities and resources to

help increase production. Our experience in working in the

Russian Federation is to act with caution, respect and genuine

reciprocity. The agreement we concluded with Gazprom

during the year to provide liquefied natural gas (LNG) cargoes

indicates the scope for co-operation to build new supply

chains in the international marketplace. We also deepened

our strategic relationship with Rosneft, Russia’s second largest

oil company, investing $1 billion in a stake at its initial public

offering in July. That investment has risen by about 25% in

value. We are also exploring the Sakhalin IV and V licence areas

in a joint venture with Rosneft and have signed a protocol with

them to carry out joint studies in the basins of the Russian

arctic region.

In 2006, capital investment in our exploration and production

segment totalled $12.1 billion, excluding our investment in

Rosneft. We added 1.4 billion barrels of oil and 1.3 trillion cubic

feet of natural gas to our booked reserves for subsidiaries and

equity-accounted entities. We have decided to move solely to

the US Securities and Exchange Commission (SEC) basis of

reserves reporting to simplify disclosures and allow for easier

comparison with competitors. Our reserves replacement ratio,

BP Annual Report and Accounts 2006 7